FINRA general counsel ROBERT COLBY, ALAN LAWHEAD have been secretly funding a multi-year online search engine optimization (SEO) campaign with FINRA’s tax-free money to suppress Google search results by depressing higher-ranked investigative stories critical of FINRA, according to recent court testimony. The unprecedented move by FINRA, which a tax-free, “non-profit” entity and a members-only, Self-Regulatory Organization trusted by the SEC to police Wall Street greed shocks industry observers and members of Congress.

Georgetown Law Chris Brummer deceives prominent Judge:

Georgetown Law Chris Brummer Deceives Esteemed New York Justice Lucy Billings, False Sworn Affidavit Perjury, Brummer FINRA NAC lies to FBI Got Caught

For the first time in recent history, the revelation underscores an “archaeological discovery” of immense magnitude of fraud committed by FINRA’s highest-ranked executives. FINRA general counsel ROBERT COLBY, former CEO RICHARD KETCHUM, and current FINRA CEO ROBERT COOK, as well as public governors BRIGITTE MADRIAN and LUIS VICEIRA are directly implicated in the FINRA fraud.

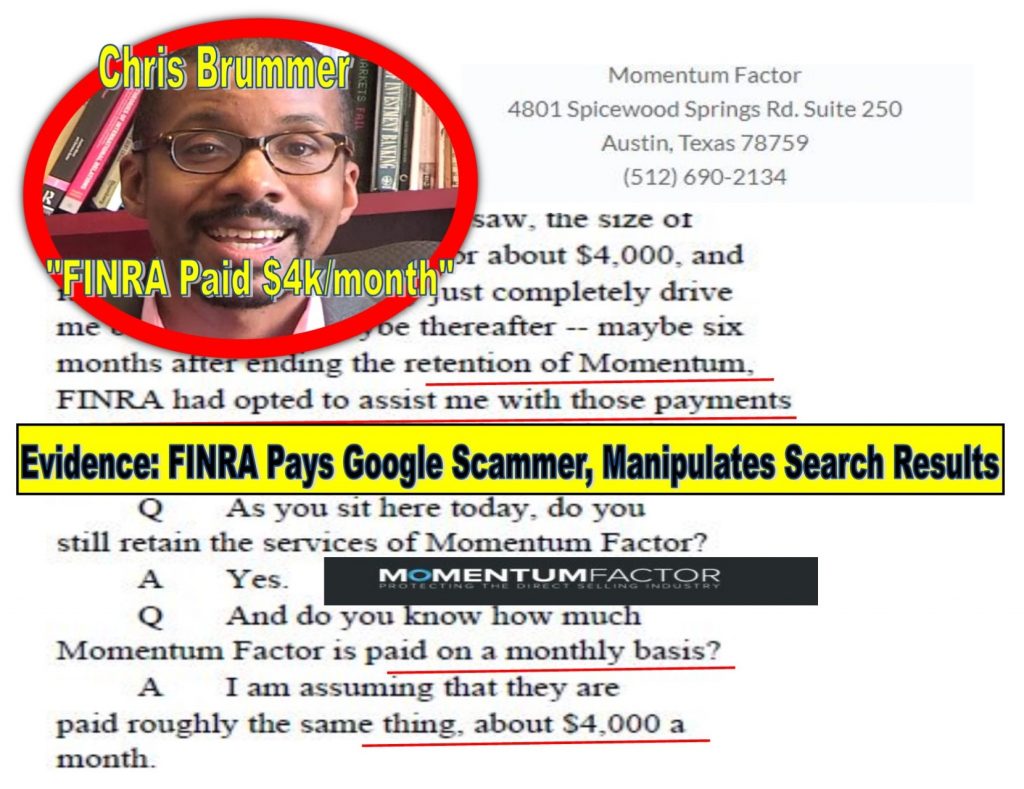

Google search manipulator shop MOMENTUM FACTOR was specifically paid by FINRA and Robert Colby to erase Google search results for “anything that negatively reflects on FINRA’s NAC and Panel hearing procedures,” sources have confirmed. The same conclusion was confirmed in a witness testimony uncovered in court proceedings.

“FINRA’s entire so-called “independent” NAC and hearing panel process is rigged,” another court record reveals.

FINRA’s Attempt at Covering Up Rigged FINRA hearings spanning at least three decades

The secret FINRA hush money payment to an obscure Texas outfit called MOMENTUM FACTOR that touts a specialty in “removing Google content” was directed by Robert Colby and paid by FINRA, disguised as FINRA’s “legal fees.” MOMENTUM FACTOR is a curious “online reputation” shop in Austin, Texas notoriously known as a shady garage with a business of defrauding Google algorithms.

Sources within FINRA say Robert Colby’s peculiar money trail to muzzle free speech was clearly intended to taper down a looming $2 billion class action lawsuit against FINRA.

FINRA’s money that intended to chill free speech was kept in the dark from the Securities and Exchange Commission, the IRS, Congress and even FINRA’s Board of Directors. No where in FINRA’s rules or public policies permits FINRA’s use of tax-free money to suppress media exposure and investigative reporting.

“Recent court documents revealed that FINRA’s ROBERT COLBY has directed FINRA to pay $4,000 a month over the last 4 years – hidden as “legal fees” to a Google search engine manipulator MOMENTUM FACTOR to prevent damaging court evidence from surfacing in Google search results. “

What worries FINRA is the exposure of FINRA’s rigging of its supposedly “independent” FINRA NAC and hearing panels’ adjudicatory process involving at least tens of thousands of FINRA’s former and current members spanning over 30 years, affecting their families and the lives of millions of Americans. Sources say subpoenas have been flying all over MOMENTUM FACTOR to compel production of FINRA’s payment records.

Related:

BREAKING NEWS: FINRA Put Up Fake NAC Member Chris Brummer Interview on Official Site, Former CEO Richard Ketchum Caught Whitewashing Rigged FINRA NAC Hearings

Particularized court testimony illustrated below shows Robert Colby’s dirty hand in the FINRA hush money payment:

Meet FINRA, the culprit behind Wall Street greed

FINRA or the Financial Industry Regulatory Authority is a self-policing regulator and a members-only close friend of Wall Street’s fat cats and obese dogs. FINRA NAC is FINRA’s in-house National Adjudicatory Council, a body of “independent” arbitrators handpicked by FINRA to discipline cases involving FINRA members. Ironically, FINRA carries a label as a “quasi-government” and “not for profit” entity, but has more than $2 billion in assets and makes net profits of at least $20 million a year – thanks to its “tax-free” status at the expense of America’s taxpayers. In truth, FINRA is a highly profitable, lucrative tax-free scam set up to pay its top brass like Robert Colby, Richard Ketchum (former CEO) and Robert Cook many million dollars a year to rape the American public.

Related:

Investigations, Lies, Confessions, FINRA NAC Chris Brummer Admits FINRA Hearings ‘All Rigged,’ Robert Colby Implicated in Fraud

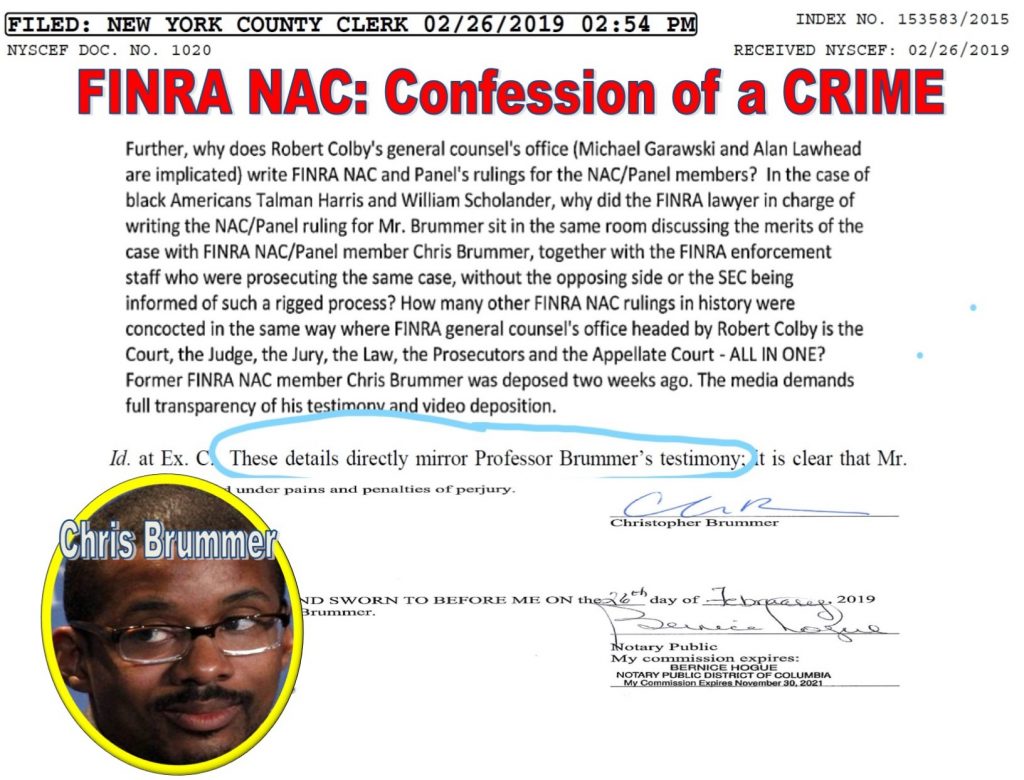

The harming evidence against FINRA was made possible by a “deep throat” inside FINRA – former FINRA NAC subcommittee chair and Georgetown Law nutty professor CHRIS BRUMMER. Brummer’s exposure of the FINRA fraud was proven true in his own words filed in court (see the snapshot below).

After suffering a devastating blow himself in his own futile try to muzzle free press, Chris Brummer decided to come clean, selling out FINRA to save his own skin.

Research shows at least 100,000 FINRA cases involving millions of American families covering decades were tainted by FINRA’s rigged FINRA NAC and hearing panels. Many of those abuses took place in the reign of FINRA’s notorious general counsel ROBERT COLBY since he joined FINRA in 2012, after the lazy Robert Colby had failed to make a living in the private sector.

Gaming Google search results, FINRA secretly pays Google Search Manipulator ‘Momentum Factor’

Since at least 2016, FINRA’s Robert Colby has been furtively channeling FINRA’s public funds to the Texas-based “online reputation firm” MOMENTUM FACTOR (www.momofactor.com, address: 4801 Spicewood Springs Rd, Suite 250, Austin, TX 78759, Tel: 512-690-2134) to trick Google search engines into concealing a wide range of court evidence and investigative stories that have exposed the rigged FINRA NAC and panel hearings. It’s unclear the extent to which FINRA Board or FINRA CEO Robert Cook may be implicated in the highly bizarre, but well-calculated FINRA scheme to cheat Google search results for the purpose of covering up FINRA’s gross misconduct.

Investigation: How FINRA rigs its entire ‘independent’ NAC and Panel Hearing Process

FINRA’s rigging of its own independent hearing panels reflects a disgusting reality and reveals a true conspiracy, where FINRA enforcement staff and the supposedly independent hearing panel members like former FINRA NAC subcommittee chair Chris Brummer secretly meet together, make panel hearing preparations together, draft and finalize hearing panel rulings together, who also collude in defending any FINRA member’s appeal of the rigged FINRA hearing decisions to the Securities and Exchange Commission.

Related:

FINRA BOARD PUBLIC GOVERNORS BRIGITTE MADRIAN, LUIS VICEIRA, HARVARD PROFESSORS SHOW RACISM, HATE BLACKS

During FINRA’s disciplinary proceedings, FINRA general counsel ROBERT COLBY is directly implicated in the FINRA fraud by personally dictating the outcomes of FINRA hearings – a task that is the sole responsibility of FINRA’s so-called “independent hearing panels” that supposedly rule based on their independent findings of facts. Hiding behind closed doors, ROBERT COLBY single-handedly decides the winner or the loser of a contested case. While FINRA rigs its independent hearings, the opposing party or their counsel is kept totally in the dark hopelessly praying for a fair trial. The FINRA targets are completely unaware that their destiny is already doomed in hell – the FINRA fix is in.

Under SEC rules, FINRA must conduct impartial and independent panel hearings devoid of conflicts, and ex-parte communications by FINRA staff with “independent” hearing panel members such as Chris Brummer are strictly prohibited. FINRA’s fraudulent conduct directly violates their SEC mandates and opens up FINRA to massive litigation.

A brewing $2 Billion-dollar class action lawsuit against FINRA

FINRA’s unsavory behavior and its riggings of the sacred independent adjudicatory process leads to dire consequences on the lives of many American families, including those of current and former FINRA members.

FINRA’s rigged hearing process which is publicly exposed in court filings could easily invite multi-billion-dollar class action lawsuits against FINRA. Several plaintiffs’ lawyers are watching closely the ongoing FINRA “deep throat” Chris Brummer’s litigation which is winding its way through the New York Supreme Court. As more evidence surfaces, FINRA is doomed.

FINRA’s ROBERT COLBY, Brigitte Madrian (current board member), former FINRA CEO Richard Ketchum, and FINRA NAC appellate head ALAN LAWHEAD are also on the depositions “chopping board” …

Related:

Lying, Cheating, Stealing: Explosive Heritage Foundation Report Exposes FINRA, FINRA NAC Regulatory Abuses

Reporters have spoken to several nationwide plaintiffs law firms that have extensive experience suing FINRA on behalf of their clients. Many are enthused about the potential of blowing up FINRA’s dark cover as a bullshit “quasi-government” entity thriving on taxpayers’ money while committing serious crimes against the public.

“I am sick and disgusted over FINRA’s fraudulent conduct. The Brummer court records are telling,” a longtime FINRA critic and plaintiff’s lawyer told the media. “This is a ticking bomb for FINRA. It’s time to tear up FINRA’s opaque regulatory scheme where FINRA plays the roles of the court, the judge, the prosecution and the jury. FINRA has ruined the professional lives of too many innocent people.”

Related:

Alan Lawhead, Robert Colby, FINRA NAC, the Corrupt FINRA Watchdog is Full of Fleas

When FINRA lands in deep sh*t, DAVIS POLK lawyer EDMUND POLUBINSKI III is the FINRA ‘toilet cleaner’

Since FINRA’s schemes erupted in the media, FINRA has hired top Davis Polk lawyer EDMUND POLUBINSKI III to desperately contain the spreading FINRA virus. According to media reports, the culprit behind the FINRA fraud, ROBERT COLBY has previously worked at Davis Polk. It’s unclear if ROBERT COLBY and EDMUND POLUBINSKI III will scratch each other’s feet. It’s also unclear if EDMUND POLUBINSKI III is as much a racist and scammer as ROBERT COLBY. The media will start following EDMUND POLUBINSKI III’s clients and reveal them in due course.

Sources say the notoriously expensive DAVIS POLK lawyers could easily cost FINRA $2,000 an hour to put out the FINRA wild fire threatening to burn down the FINRA dog house.

It also seems that the folks inside FINRA, particularly those FINRA “public governors” – board members paid to supervise FINRA management’s misconduct are distancing themselves from ROBERT COLBY and the storming FINRA scandal.

Two FINRA “public governors” BRIGITTE MADRIAN, the new Dean of Marriott Professor in the Brigham Young University business school, and Harvard executive ed academic LUIS VICEIRA have declined repeated requests for comment. Both have referred media inquiries to EDMUND POLUBINSKI III (Tel: +1 212 450 4695, Email: edmund.polubinski@davispolk.com).

FINRA public governor BRIGITTE MADRIAN subpoenaed to testify on video on May 2

The media got wind of the explosive FINRA story from court proceedings in a separate lawsuit involving sworn confessions made by former FINRA NAC subcommittee CHRIS BRUMMER. Brummer has stated under oath that FINRA has paid more than $3 million in legal fees over the last 5 years funding his lawsuit against media exposure of the rigged FINRA hearings.

Court records in the District Court of Utah show FINRA public governor BRIGITTE MADRIAN is ordered to be deposed on video at 10 am on May 2, 2019 (deposition address: 3651 N. 100 E Provo, UT 84604). Brigitte Madrian will likely be grilled over her role as a FINRA rubber stamp in aiding and abetting the FINRA and ROBERT COLBY fraud, as well as her personal involvement in orchestrating the FINRA scheme to choke free speech.

FINRA has a long, scandalous history tainted with allegations of fraud, lies and abuses

FINRA is a fat regulatory “watchdog” fed by Wall Street greed, whose highest brass each makes millions of dollars a year as the highest paid “non-profit” executives in America.

Related:

New York Judge Shuts Down Fake Fintech Expert Chris Brummer’s Scheme To Conceal FINRA Fraud

The Heritage Foundation published a scathing report on FINRA, calling on Congress to reign in FINRA abuses.

When it comes to uncovering Wall Street fraud, the FINRA watchdog is either neutered or full of fleas: FINRA has miserably missed by a large degree every single one of the disasters in recent history: FINRA completely undetected the Bernie Madoff fraud – costing investors $18 billion; FINRA’s loving relationship with Wall Street led to the recent global financial crisis – FINRA prosecuted no one on Wall Street…

The rigged “independent” FINRA NAC and panel hearing process infects at least 100,000 licensed FINRA brokers.

Stay tuned, more to come in exposing FINRA, the top regulatory abuser in America.