Editor’s Note: Sources reached out to TheBlot Magazine (Voice for the Voiceless… millions of readers each year) to share horror stories about the Nasdaq Stock Market and its proven regulatory abuses, fraudsters, racism that directly implicated Nasdaq General Counsel Ed Knight (Address: 32 W. Irving Street, Chevy Chase, MD 20815)- a shady fat cat worth $100 million. Like thieves that got caught, neither Ed Knight nor any other corrupt Nasdaq staff such as MICHEAL EMEN (Address: 13540 E. Paradise Drive, Scottsdale, AZ 85259) are willing to comment on the record, or explain to Congress what is a “Nasdaq Spirit” – the ground on which Nasdaq had wrongfully delisted China-based CleanTech Innovations – destroyed $300 million investors value – only to be reversed and strongly rebuked by the heroic SEC Chair Mary Jo White – the first time in Nasdaq’s 44 year history. This investigative story is about Wall Street greed, Nasdaq fraud, crony capitalism, racism, and corrupt regulators‘ discrimination against the minorities, which is concurred by the Forbes Magazine and Law360. In 2013, advised by Nasdaq Chairman Michael Oxley, the disgraced former head of Nasdaq listing, the notorious racist Michael Emen was fired.

On April 9, 2018, MICHAEL EMEN was sued for $300 million fraud, lying to the FBI, DOJ and SEC. Read more: Shady Michael Emen Sued for Fraud, Lying to the FBI

“As MICHAEL EMEN and his wife GAYLE EMEN suck on their toes in Scottsdale, Arizona (13540 E. Paradise Drive, Scottsdale, AZ 85259), public shareholders are living in hell thanks to their regulatory rape and abuse.”

BREAKING NEWS: On April 9, 2018, vindicated American financier Benjamin Wey sued the NASDAQ defendants for malicious prosecution and lying to the FBI, DOJ, SEC. The lawsuit filed in The Supreme Court of The State of New York (Index No. 651684/2018) charged these NASDAQ defendants: NASDAQ, Inc., The NASDAQ Stock Market LLC, CEO Adena Friedman, former CEO Robert Greifeld (Chairman of Virtu Financial Inc (Nasdaq: VIRT)), NASDAQ General Counsel and lobbyist Edward Knight, Chairman of the Corporate Governance Committee Michael Splinter, Michael Emen, Nelson Griggs, Arnold Golub, William Slattery, Alan Rowland, Keely Moxley, Robert McCooey Jr. and Andrew Hall.

Related:

https://www.theblot.com/investigations-fraud-lies-nasdaq-william-slattery-finra-robert-colby-dupe-fbi-3/

The Forbes magazine and other media outlets reported on the historic lawsuit against the Nasdaq defendants which portrays a disturbing set of facts, revealing gruesome corporate greed that implicated the highest brass of the Nasdaq.

THE LATEST UPDATES: On July 8, 2016, prosecutors in the Southern District of New York (SDNY) finally conceded that a notorious rookie FBI agent Matt Komar had misled the court, fed by lies told to the FBI by Nasdaq staff William Slattery and other Nasdaq employees. In a court filing before the highly intelligent federal judge Alison Nathan, the SDNY admitted:

“The government does not claim that NASDAQ or any other entity had in place a formal rule banning the gifting of shares in connection with a listing application.”

In January 2017, David Massey, a racist former SDNY prosecutor was caught lying, cheating and fabricating evidence in collusion with the Nasdaq. A Franks Hearing was ordered by a judge and David Massey’s lies were exposed: DAVID MASSEY, SHADY RICHARDS KIBBE ORBE LAWYER LOVES MONEY, TRASHES CLIENTS BEST INTEREST.

Nasdaq lied to the FBI – court documents reveal

In other words, the government completely made up false claims against Asian professionals. DEREK BENTSEN, STEVEN SUSSWEIN, CHERYL CRUMPTON – the three imbecile SEC staffers who had misled the DOJ with fabricated law violations have also been implicated in lying to the FBI about making up a so-called Nasdaq “300 round lot holder listing rule.”

Read more: INVESTIGATIONS: HOW NASDAQ’S WILLIAM SLATTERY, FINRA’S ROBERT COLBY LIED TO THE FBI, DUPED THE GOVERNMENT

While malicious and misinformed regulators accused China-based companies of “Chinese reverse merger “fraud, no one at the SEC or DOJ had the gall to tell the American public the truth – Israeli (Jewish) reverse merger companies far out-number the Chinese in the U.S. markets. Was it politics or racial discrimination?

“More reverse mergers companies in the U.S. are in fact from Israel, not from China. Anyone dare criminalize ‘Jewish Reverse Merger’ before they get ripped apart for anti-Semitism?”

Related:

The equally racist Nasdaq General Counsel Ed Knight was told to stop making more trouble for Nasdaq’s Board. In exchange for CleanTech’s silence, at a 2014 meeting in Washington DC attended by Nadsaq Chairman Michael Oxley and CleanTech representative – former US congressman Steven LaTourette, CleanTech agreed to cease efforts to advocate Congressional investigations into the proven charges of Nasdaq’s racism… A deal was struck. Meanwhile, Michael Emen, Ed Knight and other regulatory racists have all DECLINED to answer this basic question:

“Shouldn’t the Nasdaq listing rules be in writing – formal rules, rather than people guessing how to ‘WORSHIP’ the fabricated, racist ‘NASDAQ SPIRIT‘ as a listing standard?”

The Nasdaq and the Fabricated “Nasdaq Spirit”

Is the Nasdaq a racist, RIGGED market? Yes, the SEC agreed in a landmark 2013 ruling against the Nasdaq. Now in 2016, some obscure SEC staffers have done the Nasdaq’s bidding and continued racism. Cheryl Crumpton, an obscure SEC enforcement staffer with some shadow “spirit” of her own deeply rooted in Alabama and her racist partner Steven Susswein may still wonder why their bosses – SEC Chair Mary Jo White and other SEC commissioners had unanimously ruled against the “Nasdaq Spirit – the spirit of racism.”

“CleanTech’s disclosures have satisfied the letter of Nasdaq’s rules, but they certainly didn’t satisfy the ‘Nasdaq spirit” – Ed Knight, Nasdaq General Counsel

The SEC’s findings against the so-called “Nasdaq Spirit”?

“[T]he record does not show that the specific grounds on which Nasdaq based its delisting decision exist in fact,” – SEC Commissioners

Yes, the Nasdaq had fabricated evidence to justify its racial discrimination and destroyed an American company, the SEC concluded in a landmark ruling (here) against the Nasdaq on July 13, 2013. Then Nasdaq lied to the FBI and duped a malicious FBI agent Matt Komar, the same fraudster accused of fabricating evidence in a highly publicized case David Ganek vs FBI Agent Matt Komar, reported by the New York Times.

Read more: WILD NASDAQ LAWYER EDWARD KNIGHT VOWS TO NUKE SEC CHAIR MARY JO WHITE

Read more: WILD NASDAQ LAWYER EDWARD KNIGHT VOWS TO NUKE SEC CHAIR MARY JO WHITE

Michael Emen of Nasdaq, notorious racist under the thumb of a Wall Street “fat cat” – Ed Knight

“I hate the damn Chinese, but I am not a racist!” Nasdaq’s Michael Emen shouted and waved his hands in the air, his nose turned red like a rotten carrot sticking out of the face of a melting snowman. This outburst set the tone for a landmark racial discrimination lawsuit against the Nasdaq in 2011 (here) and a historic ruling in 2013 by the Securities and Exchange Commission against the Nasdaq. Read more: Forbes Magazine – SEC reverses Nasdaq racism, wrongful delisting of Chinese company.

At a summer event in Maryland, attorney Blair Fensterstock was seated at a table among the “Wall Street” crowd. A man with serious rhinophyma approached Fensterstock and introduced himself as Michael Emen, a former head of Nasdaq’s Listing Qualifications Department. Michael Emen is a slippery man with a notorious reputation and a checkered history as a regulatory abuser. Michael Emen barely finished school in 1971 – ranked at the bottom of his class. Unqualified for a job in the real world, Michael Emen never worked a day in the private sector. Instead, he joined the world of fuzzy bureaucrats and climbed the ranks. Thirty years later, Michael Emen could delist any company from the Nasdaq for whatever reason he likes, he abuses them and “rape” their shareholders.

Bernie Madoff, Ed Knight, the NASDAQ Chairman and General Counsel

For many, Nasdaq is a $10 billion symbol of Wall Street greed – a perilous, abusive marketplace, and sometimes a hell for America’s investors. In 2013 alone, under Nasdaq’s notorious general counsel ED KNIGHT, the rigged Nasdaq cost investors at least $500 million in its dismal handling of the Facebook IPO.

Not surprised. Nasdaq’s former Chairman is the king of Ponzi Scheme, Bernie Madoff.

Read more: lies and tyranny – NASDAQ’s hidden agenda for money, trashing human rights – Says Wikileaks.

Nasdaq General Counsel Ed Knight, the $100 million Mr. “Fix”, the culprit behind Nasdaq’s shady dealings

At the Nasdaq, Michael Emen kneels before his boss Edward Knight, a notorious Washington lobbyist know as “Mr. Fix.” “ED KNIGHT doesn’t care about the law,” said a retired Akin Gump lawyer familiar with Ed Knight’s background. “Ed Knight is a sleaze. He’s made over $100 million by lying and cheating.”

In the cigar-smoke-filled dark rooms behind the closing doors of Washington’s night clubs, Ed Knight has served his masters well. Knight was richly rewarded for his “bended knees.” Over the years, Ed Knight aligned his pockets with more than $100 million – a classic Wall Street fat cat. Public filings show Ed Knight made $15 million in 2015 alone when America’s middle class struggled to find work while many were dying from the poisoned water in Flint Michigan. As the culprit behind Nasdaq’s rotten culture of regulatory abuses and outright fraud, Ed Knight is not shy about throwing his weight around like a snake swimming in a sea of the Nasdaq bureaucracy…

Read more: FINRA Barred Two Innocent Black Brokers Based on BS, RACISM, TRASHES THE AMERICAN CONSTITUTION

“When Ed Knight gets caught lying, he lies more – including regular ‘ex parte’ communications with independent hearing panels,” SEC filing revealed. “Insider dealing is how Ed Knight does business at the Nasdaq, a trick Ed Knight has learned from years of dirty politics,” sources say.

A highly profitable energy savings company CleanTech Innovations, Inc. learned the hard way about Ed Knight. An SEC filing exposed a shining example of Ed Knight’s habit of ex-parte communications with supposedly “independent” review panels.” “Ed Knight is like a wild bull running in the streets of Madrid,” said a Nasdaq insider. “Truth doesn’t matter. It’s all BS and things get ‘fixed’ at the Nasdaq.”

MICHAEL EMEN, A RACIST BIGOT, NASDAQ FRAUD

In July 2010, CleanTech Innovations applied for Nasdaq listing. CleanTech had been formed through a reverse merger at a time when U.S. political rivalry with China was heating up. Reverse merger deals from China between 2007 and 2010 only made up for 26% of all such transactions in the U.S, according to the Public Company Accounting Oversight Board – far less than Israeli companies. Reverse merger companies represent about 15% or 800 companies in the entire U.S. markets. In Canada, Hong Kong or Australia, reverse merger companies are 40% of their markets. “It’s a mainstream product,” said a securities attorney. “There is nothing wrong with a reverse merger company except ignorance and prejudice against it.”

“Reverse mergers are often the most expedient and cost-efficient way for private companies to go public,” says Investopia.

The New York Stock Exchange, Burger King, Texas Instruments, Radio Shack, and the legendary investor Warren Buffett’s Berkshire Hathaway are reverse merger companies… In 2015, pharmaceutical giant Pfizer announced a reverse merger with the Irish based Allergan to create the world’s largest drug company, reported by the New York Times.

Read more: FRAUD SHORT SELLERS TRIGGER REGULATORS’ MISUNDERSTANDING OF REVERSE MERGERS

Michael Emen, The “Nasdaq Spirit of Racism”

After a five-month review, CleanTech listed on the Nasdaq on December 10, 2010 – only to be delisted within a month on the basis of violating the “Nasdaq Spirit.” At the time, CleanTech was lucky enough to raise $20 million in capital at the peak of the financial crisis when everything descended into hell. Nasdaq bizarrely claimed that CleanTech had “withheld” information on the funding despite the fact that the Company had timely disclosed it exactly in a way required by the SEC for a “consummated financing,” which is also written in Nasdaq’s own listing rules…

“Is a Nasdaq listing worth $20 million for investors to ‘cheat’ the Nasdaq? No. Nasdaq is so full of shit,” says a seasoned banker. “Nasdaq is a private country club. There are 60 stock exchanges in the world for a company to choose a listing venue…” The SEC agreed. In July 2013, the SEC struck down Nasdaq’s “mad cow” disease and reversed its wrongful delisting of CleanTech.

Read more: EDWARD KNIGHT, NASDAQ GENERAL COUNSEL CAUGHT IN RIGGING NASDAQ LISTING SCANDAL…

Nasdaq’s arbitrary delisting caused CleanTech’s stock to plummet from $9 in December 2010 to 15 cents – a loss of $300 million for investors and a loss of opportunities to win $100 million in contracts for wind towers in New Jersey, which would have resulted in clean air and many American jobs. CleanTech was also shut out from other exchanges – its pristine reputation had been ruined by the Nasdaq – thousands of jobs were destroyed by Ed Knight, Michael Emen and the Nasdaq…

“Violating the ‘Nasdaq Spirit’” was the reason for the Nasdaq delisting. Was the Nasdaq a religious cult? Who knows. An obscure SEC enforcement lawyer also couldn’t explain to the American public the meaning of the “Nasdaq spirit” as a ground for delisting a company. The rule was completely fabricated.

Ed Knight: “the 1.4 billion Chinese cheated the Nasdaq”

In a sworn testimony captured on tape in their own words, the blatant racist remarks made by Michael Emen and Ed Knight were appalling:

“Nasdaq has delisted CleanTech to send a message to the world… it’s not open season for the Chinese people to cheat the Nasdaq.” – Ed Knight, Nasdaq

Michael Emen went on to further exhibit his racial profiling of Chinese companies:

“CleanTech’s disclosure has satisfied the letter of Nasdaq’s law and rules, but they didn’t satisfy the ‘Nasdaq spirit‘!” – Michael Emen, Nasdaq

“Nasdaq Spirit?!” What is that? No one at the Nasdaq or the SEC seems to know. Neither Ed Knight nor Nasdaq Chairman Michael Oxley could tell reporters where to locate the so-called “Nasdaq Spirit” as a listing rule…

The truth is simple: the “Nasdaq Spirit” never existed as a listing standard. It is Nasdaq’s SPIRIT OF RACISM, orchestrated by the shameless Ed Knight and Michael Emen, supported by other regulatory racists.

Read more: CHICAGO STOCK EXCHANGE SALE TO CHINA ENDS RACIST NASDAQ MONOPOLY ON LISTINGS

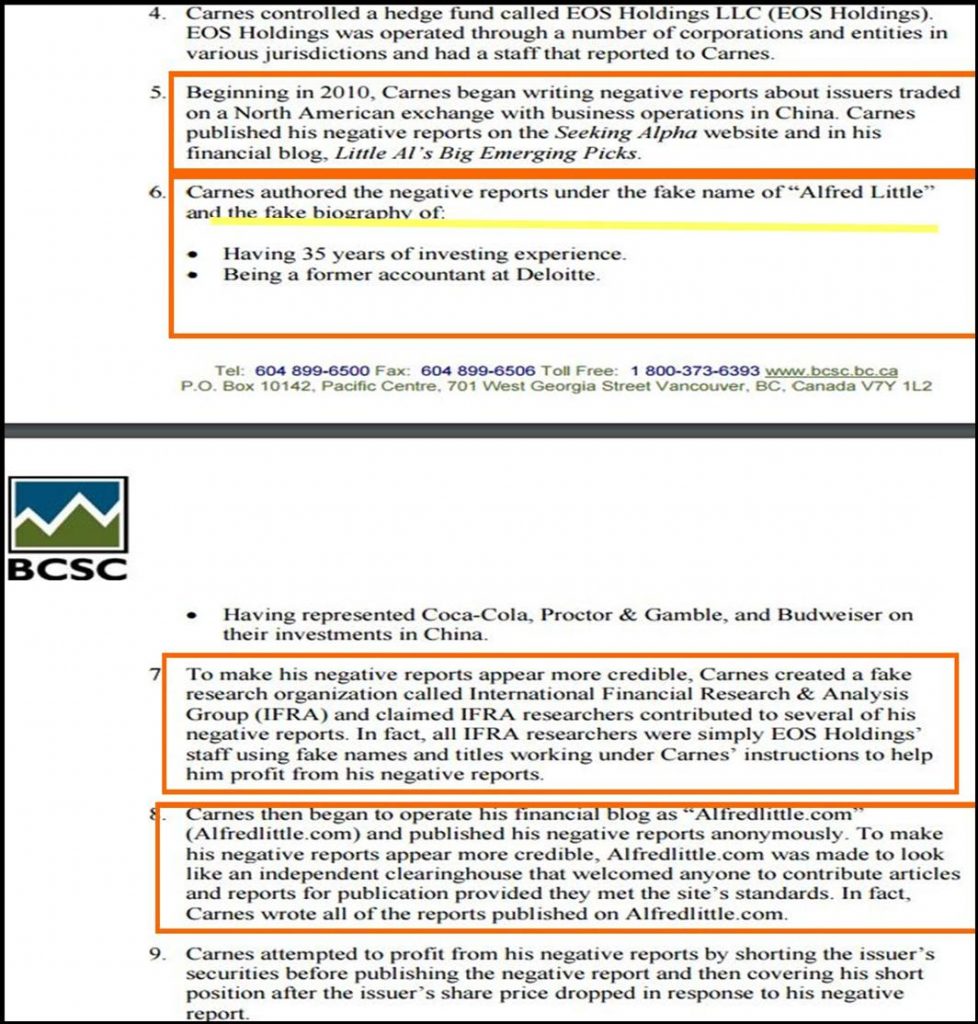

SEC staff Corruption, slippery stock short sellers Jon Carnes, Roddy Boyd fraudsters

Illegal stock short sellers played a pivotal role in feeding U.S. regulators with lies about Chinese companies. Jon Carnes, nicknamed “fatty boy” is the most notorious stock short seller who completely duped regulators. In 2014, Jon Carnes was charged by law enforcement with committing massive fraud. The crime sent his top lieutenant Kun Huang to two years in prison. Jon Carnes is also the criminal behind a tiny Caribbean nominee outfit called EOS Holdings or EOS Foundation. Fraud charges against Jon Carnes revealed a fake identity “Alfred Little” and false articles on public companies as well as massive naked short positions. To perpetrate his fraud and induce the investing public into panic selling thus driving down share prices, Jon Carnes created a fake bio for himself: a 60 year old CPA, a veteran of the Deloitte accounting firm, and a former Coca Cola and Wal-Mart executive with 30 years experience in China… It was totally made up. Jon Carnes is a 28 year old stock fraudster from South Carolina, lived in Las Vegas and is hiding in Vancouver.

In fact, Jon Carnes is a stock criminal. He has never worked a day at Deloitte or any other blue chip names. Jon Carnes took a huge naked short position in Deer Consumer Products – the largest juice maker in the world (A “Top 200 fastest growing company in Asia” – Forbes Magazine). He then published false articles on DEER, broadcast his lies on Jon Carnes’ Twittter (evidence), duped a corrupt SEC bigot staffer into investigating Chinese companies based on Jon Carnes’ lies. The poorly educated SEC staffer has never been to China, has no Chinese culture or language abilities other than yelling “Kung Pao chicken, extra meat please…” off a Chinatown menu…

Read more: STOCK SHORT SELLER JON CARNES CRIME FAMILY LANDED 2 YEARS IN PRISON, IMPLICATED BARRON’S WRITERS LESLIE NORTON, BILL ALPERT

Despite Jon Carnes‘ egregious law violations, the identified SEC “enforcement staff” did nothing to stop the criminal. Why not?

“The SEC guy is my man inside the SEC. I am his whistleblower,“ Jon Carnes said publicly.

In 2015, the brazen Jon Carnes bragged to the world on Twitter that he was the SEC staffer’s “informant” and “whilstleblower.” Readers believe the SEC staffer is a corrupt rat working for Jon Carnes inside the SEC. Bloomberg reports Jon Carnes made tens of millions of dollars from his illegal naked short stocks – some of that money allegedly was funneled to the corrupt SEC staffer Steven Susswein.

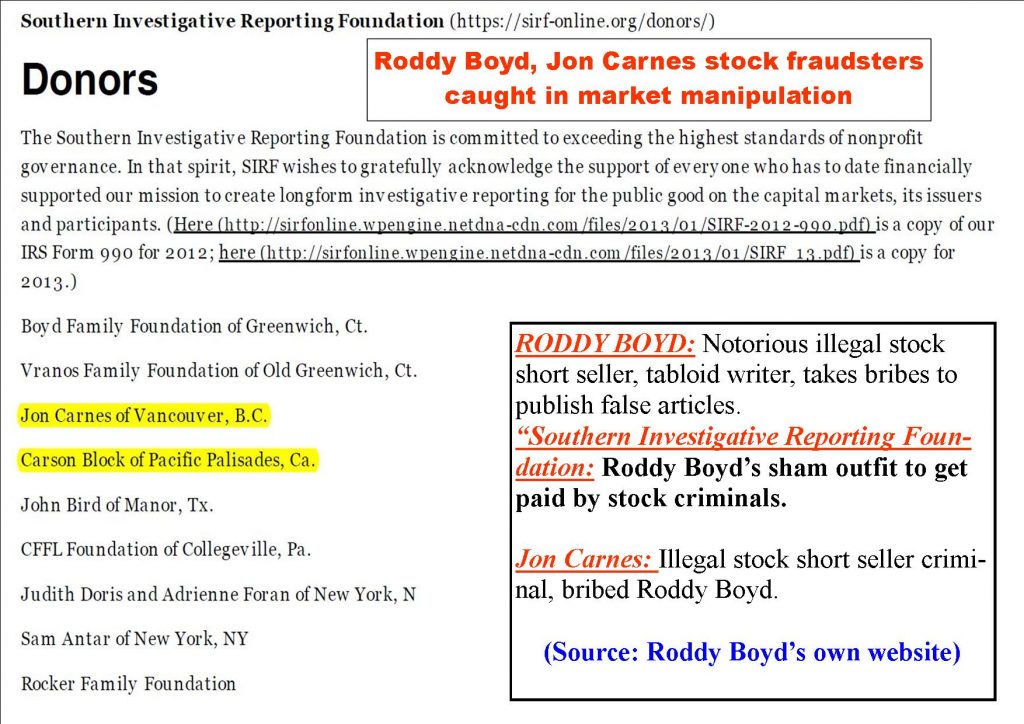

Read more: RODDY BOYD EXPOSED – FRAUD ‘JOURNALIST’ TRASHES COMPANIES, BRIBED BY JON CARNES CRIME FAMILY

More In-depth:

Tabloid writer Roddy Boyd was Jon Carnes’ co-conspirator. Roddy Boyd was bribed by Jon Carnes (evidence) to promote their false articles in order to benefit from their naked short stock positions. Has the SEC “enforcement staff” done anything to investigate Roddy Boyd? Absolutely nothing.

CleanTech followed Nasdaq’s rules. It was not enough. No one is holding Nasdaq or Ed Knight accountable for destroying American jobs and shareholders value. “It’s a country club and crony capitalism.”

SEC staffer STEVE SUSSWEIN IMPLICATED IN JON CARNES BRIBERY, SHORT SELLER STOCK FRAUD

Read more: Under Edward Knight, Nasdaq Chairman Bernie Madoff Has sick cocaine orgies…

Ed Knight, the Nasdaq lawyer for Bernie Madoff, rigged Nasdaq appeal process

CleanTech appealed within Nasdaq hearing panels twice, to no avail. Ed Knight rigged a supposedly “independent” Nasdaq Hearing and Review Council decision that had initially ruled in CleanTech’s favor. The Nasdaq Council’s ruling was “mysteriously” reversed (here) by Ed Knight, exposed in an SEC filing (here). CleanTech took its case to the SEC and exposed the classic Ed Knight “fix” in an SEC 8-K filing.

Related:

CleanTech sued the Nasdaq for racism and finally won after a 3 year battle. Nasdaq had engaged in extensive discriminatory rule-making, contrary to SEC mandates. Nasdaq even coerced CleanTech into waiving its attorney-client privilege as a per-condition to listing…. (Editor’s Note: The SEC prohibits a stock exchange from enforcing listing rules without prior approval, which is possible only after exhausting public comments published in the Federal Register. The “Nasdaq Spirit” was never found anywhere on earth as a listing rule.)

In 2011, the late Senator Arlen Specter sued the Nasdaq, Ed Knight and Michael Emen for racist discrimination and violation of the U.S. Constitution. Senator Specter stated that “delisting CleanTech is a terrible miscarriage of American justice.”

Read more: CleanTech sues Nasdaq for racism, rigging the Nasdaq listing process

JEFFREY BLOOM is an equally shady and racist character at FINRA – the Financial Industry Regulatory Authority. Before collecting a $10 million a year paycheck from the Nasdaq, the same notorious Ed Knight had run FINRA as its general counsel. FINRA is the notorious quasi-government agency that missed the massive Bernie Madoff fraud while ED KNIGHT was Madoff’s lawyer at the Nasdaq. The racist FINRA staffer Jeffrey Bloom is exposed. Read more: LIES AND INCOMPETENT FINRA REGULATOR JEFFREY BLOOM MISSED NEW BERNIE MADOFF.

“NASDAQ FABRICATED DELISTING EVIDENCE…” THE SEC CONCLUDED

In a rare and landmark decision, the SEC issued an order against the Nasdaq and Michael Emen on July 13, 2013 and reversed the wrongful delisting of CleanTech. The SEC commissioners stated in their unanimous decision: “[T]he record does not show that the specific grounds on which Nasdaq based its delisting decision exist in fact.” In other words, the Nasdaq was caught pants down rigging its listing process, concluded the SEC. Nasdaq had “manufactured” evidence to hide their racism against the Chinese. Calls to Ed Knight seeking comments were not returned. SELIG SACKS, an obscure lawyer with a history of “sacking” Chinese companies with excessive fees also declined to comment.

Read more: Forbes – In Rare Move, SEC Reverses Nasdaq’s Delisting Of Chinese Company

After CleanTech was exonerated by the SEC, the company issued a public statement: “This historic SEC decision rights a great wrong that was done to CleanTech and company investors by Nasdaq,” said CleanTech Chief Executive Bei Lu in a statement to Forbes. “It raises serious questions about the Nasdaq treatment of CleanTech and other companies run by the minorities.”

MICHAEL EMEN, DYING IN DISGRACE

Throughout his career, Michael Emen worked in Rockville, Maryland – 400 kilometers away from New York City, Michael Emen remote-controlled America’s capital market. How? He learned about the complex Wall Street world by making daily visits to Yahoo chat rooms and reading the Barron’s tabloid – Wall Street’s “rumor mill” filled with short seller manipulation:

“Whatever is said in the Barron’s, it must be true! Barron’s is the Bible of Wall Street,” Michael Emen said

Michael Emen was duped by stock manipulators at Barron’s: Leslie Norton and Bill Alpert, exposed in this article: JON CARNES CRIME FAMILY LANDED 2 YEARS IN PRISON, IMPLICATED BARRON’S WRITERS LESLIE NORTON, BILL ALPERT. Read more: CATCHING STOCK FRAUD CRIMINAL JON CARNES, THE REAL-LIFE WOLF OF WALL STREET.

Michael Emen’s dismal life was shortened by late-stage prostate cancer. Traynham Mitchell, Michael Emen’s co-conspirator at the Nasdaq died of bladder cancer in 2013 from non-stop bleeding over a toilet. Fired by the Nasdaq, Michael Emen is quietly dying after a 30-year career as a shameless bureaucrat – forever tarnished as a proven racist and a “paid gun” for Ed Knight.

Read more: GARY SUNDICK, MICHAEL EMEN, NASDAQ LISTING ABUSERS CELEBRATE EULOGY FROM HELL

William Slattery, Nasdaq’s “young buck”, lied to the FBI

In 2014, the Nasdaq “house of cards” were passed down to a young kid named William Slattery. Andrew Hall, a bright American executive served as a co-director in charge of Nasdaq’s new listings.

“According to Steve Susswein, Nasdaq’s WILLIAM SLATTERY is the man who had told both the SEC and the FBI about a bizarre ‘300 round lot’ share gifting Nasdaq ‘rule’ that in fact never existed. Just like the ‘Nasdaq Spirit,’ it was complete Nasdaq fabrication. In a recorded 2015 speech, William Slattery said publicly that ‘gifting shares to gain Nasdaq listing’ is a ‘recurring practice’ among many Nasdaq companies…In March 2016, the FBI agent MATT KOMAR was sued by fund manager David Ganek for ‘fabricating evidence.'”

In 2015, CNBC reports that gifting shares has gained popularity in America and share certificates are now sold at retail stores like phone cards. There is no rule anywhere that says gifting shares is illegal even for the purpose of listing on a stock exchange. “It’s a recurring event at the Nasdaq…” says William Slattery. “Good luck putting the nation’s grandmas in handcuffs for their gifting of their stock certificates to grand kids…” said legal experts.

Read more: OP-ED: CAN’T FIND CHINA ON A MAP? RACIST SEC LAWYER DEREK BENTSEN HUNTS ASIAN SCALPS ANYWAY

“In July 2016, prosecutors in the New York Southern District admitted the Nasdaq “300 round lot rule” was fabricated. William Slattery committed a crime by lying to the FBI.”

Nasdaq listing – a cheap commodity competing against 60 other stock exchanges

Nasdaq is one of 60 stock exchanges in the world. Stock exchanges compete like mad dogs for survival. They make money from charging companies recurring listing fees. Racial profiling against foreign companies has caused Nasdaq to continue to lose market shares. Nasdaq had more than 5,600 listed companies eight years ago. Today, less than 2,800 are dwindling on the Nasdaq. Racism under Ed Knight has contributed to Nasdaq’s demise.

“Capital has legs. Unless you have the right environment, it walks away from you,” says Harvard Business School

Since the wrongful delisting of CleanTech, Nasdaq has fired its entire Listing Department. Racism is still rampant today at the Nasdaq. Companies listed on the Nasdaq have since left the rigged marketplace in droves, reported by the Wall Street Journal.

Read more: Chinese Regime Demanded NASDAQ Eject Anti-communist TV Network, Wikileaks Cable Says

The Nasdaq corruption, bribes to the Chinese government in violation of FCPA, Wikileaks says

ED KNIGHT, the notorious NASDAQ General Counsel has declined repeated requests for comment. ARNOLD GOLUB, an obscure Nasdaq staffer and Ed Knight surrogate has also declined to comment. Nasdaq was approved to open a Beijing office in September 2007 after agreeing with the Chinese government to suppress human rights, evicting the long standing anti-communist New Tang TV from the Nasdaq Market site, according to the U.S. Embassy cables, exposed by Wikileaks.

Lawrence Pan, the former Nasdaq China head arrested by Chinese police was reluctant to go on the record: “I am glad the Nasdaq paid Chinese officials money to open a Beijing office. Nasdaq was dying for new businesses in 2007 and the Chinese company listings saved the Nasdaq,” Pan said to reporters. Bribing foreign officials directly violates the Foreign Corrupt Practices Act (FCPA). An investigation into NASDAQ’s FCPA violations could be a solid starting point to uncover Nasdaq’s shady practices…

In 2015, public filings show Ed Knight sold at least $15 million in Nasdaq stock at artificially inflated prices. While the market manipulator Ed Knight was laughing all the way to the bank, the laid-off workers of CleanTech had a tough time finding work in the bitter cold winter… As Ed Knight flies on a private jet growing fatter with his checkbooks, the average American family struggles to make ends meet. “This ain’t fair… this is not what America ought to be,” said a former CleanTech employee.

“The stock market is rigged, Nasdaq is one of the worst players on the chess board screwing over American investors,” Well said, Michael Lewis.