Worldwide Acceptance of Reverse Merger, Except America?

Reverse merger is simple and completely legitimate. The facts are clear and the conclusions are self-evident.

1) About 40% of all companies listed on the Australian Stock Exchange are reverse merger companies.

2) About 40% of all companies listed on the Canadian markets are reverse merger companies.

3) About 20% of all companies listed on the U.S. markets (NYSE, NASDAQ, OTC) are reverse merger companies, with the most recent and the largest reverse merger deal being Burger King on the NYSE.

4) About 40% of all companies listed on the Hong Kong markets are reverse merger companies.

Equivalent Disclosure — IPO vs. Reverse Merger

In the U.S. and elsewhere, reverse merger companies and IPO companies follow exactly the same listing standards and continuing listing standards on their respective stock exchanges. The reverse merger process is not only 100% legitimate, but is also a vital part of capital formation. The process gives issuers/companies and their shareholders the ultimate control over the timing of their capital raise processes, instead of being subject to the uncertain possibility that underwriters will unilaterally cancel the IPO at the last minute after the issuer has incurred large audit, legal and other costs in preparation.

Related:

RODDY BOYD EXPOSED – Fraud ‘Journalist’ Trashes Companies, Bribed by Jon Carnes Crime Family

As we have seen in Hong Kong, underwriters’ evaluations of market conditions have doomed many proposed IPOs, and the same thing happened during the U.S. financial crisis of 2008-2012. Read more: ANGRY GRANDMAS IN ARMS PROTEST ABSURD SEC CLAIM: GIFTING STOCKS AWAY ILLEGAL IN AMERICA?

Reverse Merger, the Definition

What is a reverse merger? A private company merges its business with a publicly traded company, and the private company’s shareholders become the controlling shareholders of the post-merger public company. That’s the end of it!

Stock exchanges and regulators such as the SEC enforce listing rules and disclosure requirements for reverse merger companies exactly the same way as they govern all IPO companies on their exchanges, as evidenced in the recent NYSE-listed Burger King — it was a U.K. shell company that dual listed on the NYSE after a reverse merger. There were no underwriters involved and that was not an IPO. Burger King’s CFO stated on the record during the NYSE listing, as reported by The Wall Street Journal that Burger King executed the reverse merger “to avoid an IPO to save time and focus on business.”

Why America Alone Is Biased — the Regulators Drank the Kool-Aid

The unfortunate thing is that the United States is the only place in the world where regulators, legislators and ordinary citizens often put a negative connotation on a lawful and simple process called a reverse merger. They have swallowed — hook, line and sinker — a massive and successful propaganda campaign by market-manipulating short sellers and their allies in the press and the blogs. Up to a hundred articles over the last couple of years have characterized the reverse merger technique with the stock (but false) phrase “a backdoor method of entering the public market which avoids the regulatory scrutiny of an underwritten IPO.”

Related:

VINDICATED AMERICAN FINANCIER BENJAMIN WEY HIRES PLAINTIFFS LAWYERS, SEEKS DAMAGES, JUSTICE

In fact, in the U.S. reverse mergers are not “backdoor” (furtive, illicit or secret). The SEC has robust regulations requiring all of the disclosure required in an annual report on Form 10 for any reverse merger. And since a reverse merger does not per se raise any capital, it is usually accompanied by a private institutional financing (“PIPE”: private investment in public equity), which obligates the issuer to register the shares on an S-1 registration statement with the SEC — the same form on which IPOs are registered. The SEC reviews S-1s of reverse merger companies no less than it reviews IPO S-1s. Read more: FRAUDSTER, TABLOID WRITER RODDY BOYD IMPLICATED IN MULTIPLE FRAUDS.

Read more: CORRUPTION, LIES, HOW SEC ENFORCEMENT STAFF CHERYL CRUMPTON, DEREK BENTSEN DRINK THE NASDAQ ‘POISON KOOL-AID’

Reverse merger vs. IPO, Comparable Due Diligence

In the case of an underwritten IPO, the managing underwriters conduct a due diligence investigation of the issuer before selling the shares to others after owning the shares for less than a day. In the case of a reverse merger and PIPE, the institutional investors conduct an intense due diligence investigation of the issuer (including one or more trips to China in the case of China-based businesses) before writing checks for millions of dollars and holding the shares for months or years.

One could argue that the due diligence investigation by actual institutional investors is more intense and thorough than the underwriters’ process to create a “due diligence” defense to possible Securities Act lawsuits. Thus the concept that a reverse merger and PIPE are scrutinized less than IPO companies by investment professionals, by the SEC or by stock exchanges is simply not true.

A couple of reverse merger companies could exemplify quality reverse merger companies:

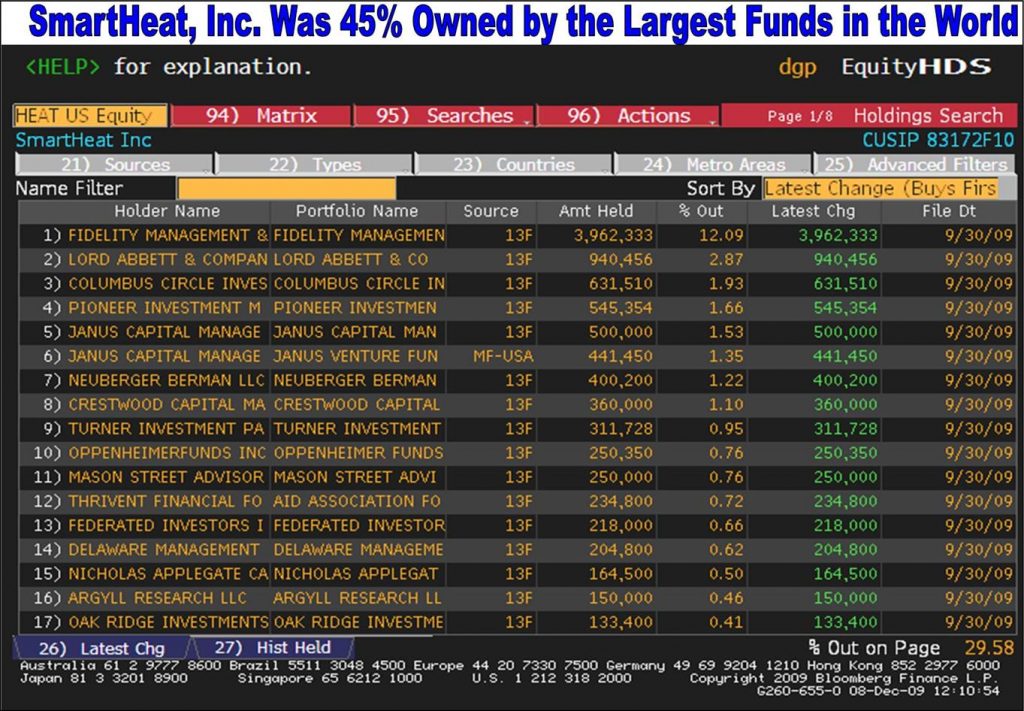

SmartHeat, Inc. (Nasdaq-listed): a reverse merger company

Deer Consumer Products, Inc. (Nasdaq-DEER): a reverse merger company

Do SEC Policies Harm U.S. Small Business?

Do SEC Policies Harm U.S. Small Business?

Yet despite the patent irrationality of this bias against the reverse merger technique, the SEC in 2011 forced all American stock exchanges to adopt a special listing rule to single out reverse merger companies for up to two years in the penalty box before they can be listed — a rule which does not apply to IPO companies. This is very harmful to small business and job creation in the U.S. Although a major aim of regulators was to restrain China-based businesses, 70% of all reverse mergers in the U.S. are not Chinese or other foreign-based businesses, but small U.S.-based U.S. corporations, the source of most of America’s job creation growth. Read More: Stanford University research: Chinese Reverse Merger Companies Outperform U.S. Counterparts.

Related:

Tabloid Writer, Fraudster RODDY BOYD Implicated in Multiple Frauds

The World Thinks America Is Silly for blaming reverse mergers

Market participants in Canada, Australia, Europe and Hong Kong have expressed amazement that the U.S. takes such an irrational attitude to a lawful and morally neutral corporate technique. Whether a company has had an IPO or reverse merger does not determine whether the company will violate securities laws and proper accounting principles — any more than does the state of its incorporation. The behavior of management does. The New York Stock Exchange is a reverse merger company. Enron and Worldcom were IPO companies.

Prominent reverse merger companies, regulatory abuses

Investors don’t care if a company is a reverse merger – misconstrued by the SEC, DOJ bureaucrats, or a risky IPO, says Stanford University research. The NYSE, Berkshire Hathaway (Warren Buffett merged with a garment factory), Burger King, the $160 billion Pfizer-Allergan merger – the world’s largest pharma deal, plus 600 other U.S. listed companies are all reverse mergers. Bloomberg reported in Feb 2017 “reverse merger listings created billionaires worth $47 billion.” NASDAQ itself was a Form 10 public shell, not an IPO. 40% of public companies in China, Canada, Hong Kong, UK are reverse mergers – says Bloomberg. The SEC bureaucrats coined a racist term “Chinese reverse merger.” But far more Israel-based reverse merger companies trade in the U.S. than those from China. Why haven’t the SEC enforcement staff Melissa Hodgman, Derek Bentsen, Cheryl Crumpton, Steven Susswein, Patrick Feeney, Stephanie Avakian labeled Israeli firms as “Jewish reverse mergers?“ How soon are they fired as anti-Semites? Reverse merger is a routine, common business practice, defined by Investopedia. On May 26, 2017, The Wall Street Journal reported NYSE pursues listings of SPACs, reverse merger, direct listing companies.

Related:

Fraud, Lies, Tabloid Writer Roddy Boyd, A Curious Fraudster for Stock Short Sellers

The New York Times reported that a leading Chinese American financier Benjamin Wey defeated a completely trumped-up case in a fake reverse merger prosecution. Forbes magazine reported that Benjamin Wey won a landmark victory over regulatory abuses. The New York Law Journal says a federal judge declared a rigged prosecution against financier Benjamin Wey “unconstitutional.”

U.S. Securities Regulators Conned by ‘Short and Distort’ Frauds and Gangsters

The U.S. has lost a vital capital formation process by demonizing something that is a perfectly normal and lawful corporate transaction that is of great benefit to growing companies, which cannot justify the underwriters’ minimum size IPO of $50 to $90 million. The perception of “something is wrong” with the reverse merger process reflects relentless propaganda cranked out by yellow journalists who claim not to receive compensation from short sellers, whose positions benefit from the so-called “news” articles and exposés.

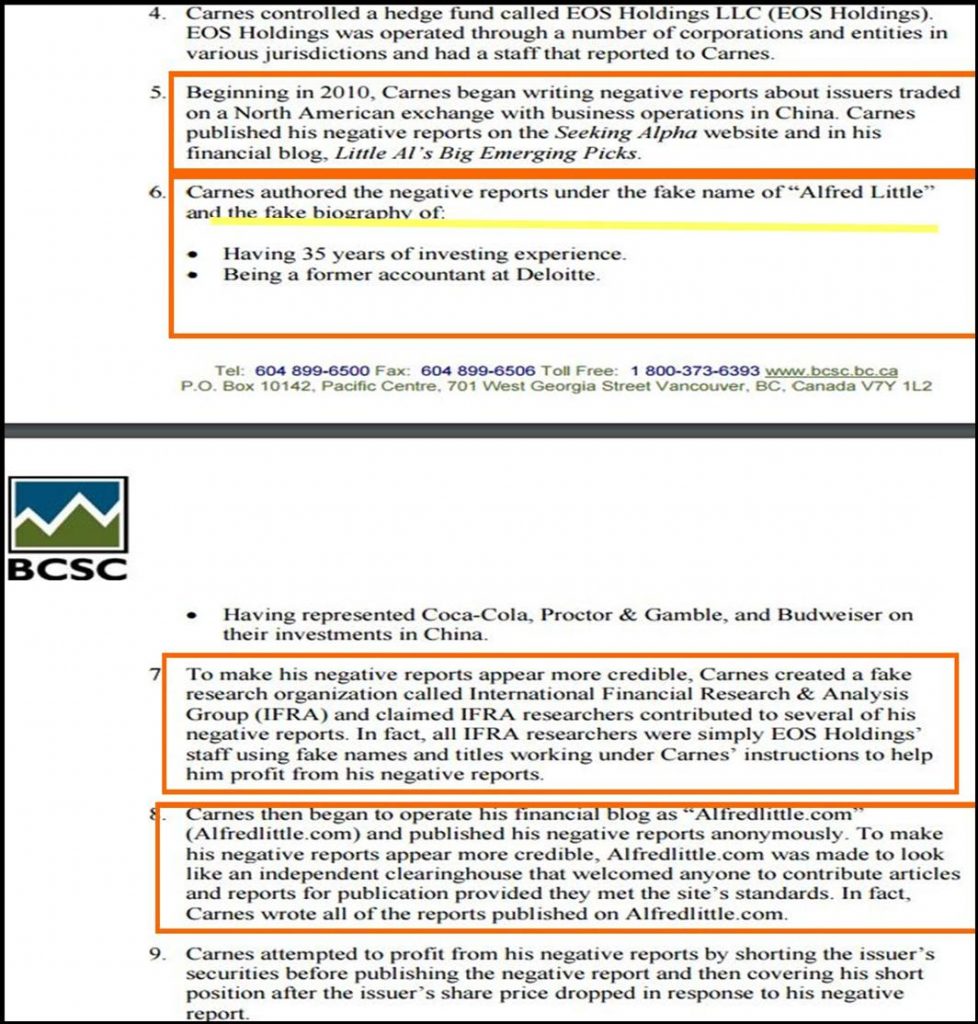

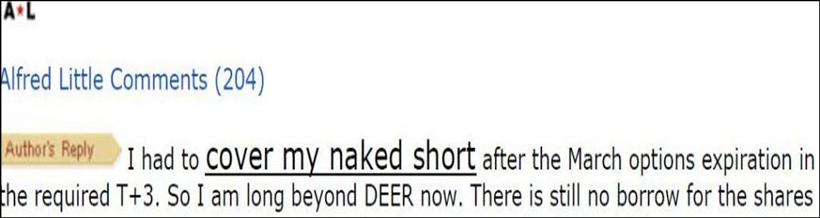

And there are market-manipulating illegal short sellers using false names to publish even less responsible blog articles as a signal to their co-conspirators to begin or intensify a coordinated, often naked, short attack. One thinks of “Alfred Little,” who has belatedly been unmasked as international hedge operator Jon Carnes, now a self-described card-carrying SEC “whistleblower” after his vicious anonymous blog articles destroyed millions of dollars of U.S. investors’ capital. Read more: SEC STAFFER STEVEN SUSSWEIN CAUGHT IN ABSURD SEC CLAIM: GIFTING STOCKS ILLEGAL IN AMERICA?

After a honeymoon with the SEC and NASDAQ, when he and his fellow travelers fed false information to NASDAQ and other regulators, resulting in wrongful de-listings, the jig is finally up. Carnes is facing serious fraud charges in British Columbia, surprisingly with assistance from the SEC. Some of Carnes’s co-conspirators in China, who pretended to be an independent research organization, have been jailed for market manipulation. We hope that the SEC will begin to focus on the fact that market manipulation on the downside has been an unchecked attack on American investors for years. Market manipulators and illegal short sellers have applied the typical “short and distort” tactics by portraying a simple merger technique as something with much larger and imaginary implications. Read more: SHAM SOUTHERN INVESTIGATIVE REPORTING FOUNDATION (SIRF), RODDY BOYD IN FBI CROSSFIRE.

The stated rationale for the special reverse merger listing rule was that regulators had heard allegations of fraud among China-based reverse merger companies. Therefore, every reverse merger company, though fully compliant with the law, would be punished.

Related:

Fraud SOUTHERN INVESTIGATIVE REPORTING FOUNDATION, SIRF, RODDY BOYD in FBI Crossfire

This is like saying since one heard allegations of fraud in a Delaware corporations or corporations with a Baptist or Catholic or Jewish CEO, then all Delaware corporations or corporations with a Baptist or Catholic or Jewish CEO should be punished. The irrational baseless special reverse merger listing rule should be repealed. Read more: STOCK SHORT SELLER JON CARNES CRIME FAMILY LANDED 2 YEARS IN PRISON, IMPLICATED BARRON’S WRITERS LESLIE NORTON, BILL ALPERT.

Eye Opening Research from Stanford University

This Stanford University research paper, “Shell Games: Are Chinese Reverse Merger Firms Inherently Toxic?”, makes for good reading and serves as independent verification of our observations. Since 2010, we have been very actively funding and investing in U.S.-listed Chinese companies that have made announcements to exit the NASDAQ Stock Market. This is America’s loss. “Capital has legs. Unless you provide the right environment, it walks away from you.” — Columbia Business School. Well said.

Mr. James Baxter, an attorney and graduate of Yale University and Harvard Law School, is a former Executive Chairman and General Counsel of New York Global Group, a leading private equity investor and corporate adviser engaged in investments and acquisitions globally through New York and Asia-based co-branded entities. Mr. Baxter is an officer of the Financial Services Committee of the Association of Corporate Counsel and has acted as an independent arbitrator for FINRA for almost two decades.