THE LATEST UPDATES: On March 27, 2017, a New York federal judge DISMISSED all SEC charges against American hero lawyer WILLIAM UCHIMOTO. SEC regulatory rapists MELISSA HODGMAN, DEREK BENTSEN, CHERYL CRUMPTON, STEVEN SUSSWEIN, PATRICK FEENEY, JOSHUA BRAUNSTEIN were caught pants down lying. On May 2, 2017, New York Federal Judge Alison Nathan ordered the Nasdaq to produce documents concerning the Nasdaq and SEC’s completely made-up “Nasdaq 300 round lot shareholder gifting rule.” Melissa Hodgman and her fellow abusers were served a Rule 11 Sanctions Motion by William Uchimoto, publicly exposed through several FOIA requests to the SEC. Who’s on the hook for hundreds of millions of dollars in damages to public shareholders? The Nasdaq or the SEC? Let’s find out:

WILLIAM UCHIMOTO, the “Asian scalp” for the Securities and Exchange Commission (SEC)

Japanese American lawyer WILLIAM UCHIMOTO is outraged during a September 2015 interview with the American Lawyer magazine:

“SEC staff Steven Susswein and Cheryl Crumpton outright lied about the facts. They wanted to claim some Asian Scalps from a 5 year wild-goose chase. I have an Asian Scalp, come get it!”

THE LATEST ON TV: THE SEC SCANDAL BEHIND THE FALSE PROSECUTION OF JAPANESE AMERICAN LAWYER WILLIAM UCHIMOTO.

The somber outburst from William “Bill” Uchimoto, one of America’s top lawyers is a reminder to Americans that their government bureaucrats are abusing their power. Three imbecile SEC enforcement staff Steven Susswein, Cheryl Crumpton and Derek Bentsen stood out from the crowd of trolls, holding “sharpened knives” pointing straight at William Uchimoto’s face.

Read more: MELISSA HODGMAN, Racist SEC Enforcement Staffer Wants Pay Raise, Not the Truth

“We want to get that Jap Uchimoto,” said Steven Susswein, a Securities and Exchange Commission (SEC) “enforcement” staffer seriously overweight, whose $195 k a year job seems to be total government waste. Indeed, watching these government abusers skinning an American’s reputation can be life-threatening.

Read more: FRAUD, LIES, SEC STAFF STEVEN SUSSWEIN, CHERYL CRUMPTON SLAMMED IN FEDERAL COURT

WILLIAM UCHIMOTO, SEC lawyer, a purple heart family, an American war hero

WILLIAM “BILL” UCHIMOTO is a highly regarded American lawyer. Born in a Japanese internment camp to a Japanese American family, the Uchimotos have a long history of American patriotism. Bill Uchimoto’s father Dan Uchimoto is a famed American war hero, who is also a wounded veteran and the highest decorated Japanese American soldier in World War II – a patriot that risked his own life pulling hundreds of Jews out of concentration camps in Poland and Germany. William Uchimoto grew up in a purple heart family, swearing allegiance to the only flag he knows – the American flag. William Uchimoto was a whiz kid at a very young age. He graduated at the top of his class from the Hastings law school in 1981 and joined the SEC’s Division of Trading and Markets in charge of regulating stock exchanges.

“The SEC was a great place in the 1980s. The staff cared about the truth. I proudly served as a market regulator,” said William Uchimoto. For 35 years, Uchimoto has maintained a spotless record known as a lawyer of high integrity. Critics say the SEC’s culture of fairness has since changed. “Nowadays the SEC’s enforcement actions are often not based on facts, rather are driven by politics or staff lies and fantasy stories to claim human scalps at any cost,” said in a Wall Street Journal article titled Refusing to Buckle to SEC Intimidation.

Read more: CAN’T FIND CHINA ON A MAP, IMBECILE SEC LAWYERS LYNCH THE CHINESE

A bogus SEC charge, a nasty $30 PR hatchet job

In 2015, two obscure SEC staffers Steven Susswein and Cheryle Crumpton filed an absurd lawsuit against Bill Uchimoto in a pathetic replay of the same SEC abuses criticized by the Wall Street Journal. “These SEC bureaucrats are manufacturing rules and laws and prohibiting people from gifting their own shares,” said a Journal reporter. “It’s none of their damn business who an investor wants to give her stocks to.”

The notorious Nasdaq general counsel Ed Knight, who was sued for racism and strongly rebuked in a 2013 SEC ruling for rigging the Nasdaq listing process is the man behind the SEC “mad dogs.” Ed Knight retaliated against Bill Uchimoto only after Uchimoto had served as a key witness in the landmark SEC ruling against the Nasdaq, exposed by the Forbes Magazine.

Read more: ANGRY GRANDMAS IN ARMS PROTEST ABSURD SEC CLAIM: GIFTING STOCKS AWAY ILLEGAL IN AMERICA?

SEC staffers STEVE SUSSWEIN and CHERYL CRUMPTON charged Bill Uchimoto with “allowing his clients to gift their shares to their friends and families thus defrauded the Nasdaq.” “Gifting shares is illegal in America!” announced the obscure and fat SEC staffer Steven Susswein.

Steve Susswen and Cheryl Crumpton said Mr. Uchimoto’s incentive for his “fraud” was a gift certificate he had received from a friend more than 10 year ago. The value for such a gift certificate? $30. Literally, Bill Uchimoto’s 35-year pristine reputation was ruined by the two imbecile SEC staffers because of a $30 Christmas gift. A misguided SEC case? In court filings, Uchimoto’s lawyer Daniel Zinman blasted the SEC’s absurd accusations:

“The SEC’s baseless, stale claims against Uchimoto have done incalculable harm to his unblemished reputation, leaving him stained with the taint of an alleged fraud…”

The SEC staffers: “No ‘law’ found on earth, heading to Mars”

“Did the SEC staffers Steven Susswein and Cheryle Crumpton fabricate the law against Bill Uchimoto?” Bill Uchimoto thinks so during an interview with the American Lawyer magazine in 2015. “Stock short sellers had their fingerprints all over this,” others agree.

Read more: OP-ED: CAN’T FIND CHINA ON A MAP? RACIST SEC LAWYER DEREK BENTSEN HUNTS ASIAN SCALPS ANYWAY

“No law exists that prohibits someone from gifting her stocks to friends, families or business contacts,” says a legal expert. “Do these idiotic SEC staffers have any common sense at all?”

“I met Steve Susswein and Cheryl Crumpton two years ago to help them out with whatever they were looking for. That’s the last I heard from them,” Bill Uchimoto said to American Lawyer. “For 35 years, I’ve had a spotless record as an attorney advocating for my clients. These ignorant SEC staff have ruined my life. How can we teach such stupid people human decency and basic common sense?”

“Steve Susswein and Cheryl Crumpton lied the moment they opened their damn mouths,” Mr. Uchimoto said. “They deliberately went off the record during a 2014 deposition so their racist prejudice against the Chinese would not be recorded.”

“These three shameless SEC staffers will be exposed publicly,” said William Uchimoto. Since no evidence was found on earth, are the government staffers Steven Susswein and Cheryle Crumpton, MELISSA HODGMAN flying to Mars to collect evidence against Uchimoto?

WILLIAM UCHIMOTO, the lawyer who “wrote the law” on NASDAQ listing

While at the SEC in the 1980s, BILL UCHIMOTO approved the listing standards for the brand new Nasdaq Capital Market. “If the Nasdaq wants to have a new listing rule, it must apply to the SEC for a rule change,” said Robert Colby, FINRA’s general counsel. “Before the SEC approves it, it’s not a rule, period. There is no rule prohibiting someone from gifting her own shares for whatever reason. They are her property.”

It’s bizarre Steven Susswein and Cheryle Crumpton sued Bill Uchimoto – the “law professor” who literally had written the law book on Nasdaq listing.

“I approved the Nasdaq listing rules. I know what they are,” said William Uchimoto. “Steve Susswein and Cheryl Crumpton fabricated a Nasdaq ‘300 round lot holder gifting rule’ that doesn’t exist anywhere in order to claim some Asian scalps.”

Facing media criticism, Steven A. Susswein and Cheryl Crumpton have been hiding from the public like burglars that got caught.

Read more: FRAUD, LIES, SEC STAFF STEVEN SUSSWEIN, CHERYL CRUMPTON SLAMMED IN FEDERAL COURT

WILLIAM UCHIMOTO, the youngest general counsel of a major stock exchange

At age 33, William Uchimoto joined the Philadelphia Stock Exchange and became the youngest Chief Legal Officer in the U.S. history of a major stock exchange. William Uchimoto immediately set his eyes on the emerging markets of mainland China. “The U.S. has efficient capital markets, and China is the biggest growth engine of the world,” William Uchimoto said. “China should be our closest ally. We can help each other achieve prosperity.” Years later, William Uchimoto joined Buchanan, Ingeroll & Rooney, a fast growing national law firm as its Chair of China Practice. Under Uchimoto, Buchanan became a top law firm specialized in China transactions. In 2009, William Uchimoto was named the Diversity Attorney of the Year.

“China had no subprime mortgage problems. Everyone wanted a piece of China. Bill Uchimoto was the best lawyer out there,” said a banker at Maxim Group. “Bill Uchimoto has great integrity. He is a strong advocate for his clients and they follow his advice.”

NYSE, Nasdaq’s China “Gold Rush” since 2007

The NYSE and Nasdaq welcomed Bill Uchiomto’s clients with open arms. Uchimoto became known as the go-to lawyer for high quality corporate listings. “The Nasdaq made millions off Chinese companies and we served them well,” said Eric Landheer, Nasdaq’s former president of Asia Pacific. Bill Uchimoto stood out as a leader in the hot China space.

“We were grateful to professionals like Bill Uchimoto for introducing Chinese companies to the Nasdaq,” said Eric Landheer, Nasdaq Asia CEO

Nasdaq fiercely competed with the NYSE to attract Chinese listings. In 2007, Nasdaq and the NYSE eagerly opened their Beijing offices – a splashy opening with Champagne toasting attended by the Chinese Premier and U.S. Treasury Secretary Hank Paulson. In 2008, China spent $585 billion amid global recession and drove its economy to an enviable growth of 9.6%. China was the world’s only growth engine and investors took notice. Nasdaq hired local staff, printed brochures in Chinese touting the benefits of Nasdaq over the NYSE. Nasdaq aggressively marketed itself to lawyers, bankers and corporate advisers. Nasdaq CEO Robert Greifeld personally solicited many of the Chinese listings. By 2011, more than 180 Chinese companies had joined the Nasdaq. Between 2006 and 2011, U.S. mutual funds couldn’t get enough of Chinese stocks – favored those listed in the U.S. and Hong Kong.

“By 2010, more than 700 Chinese issuers were listed in the U.S. Of which, 226 were on the NYSE, AMEX and the Nasdaq.”

A third of the Chinese companies went public through reverse merger. By 2013, reverse merger companies were 20% of the entire U.S. markets that included the NYSE, Burger King, Berkshire Hathaway and many other icons. Investopia says reverse merger is a “cost efficient way to go public.” By 2016, about 40% of listings on stock exchanges in Canada, Hong Kong and Australia are reverse mergers. About 800 U.S. public companies have become public through reverse merger.

Read more: FRAUD SHORT SELLERS TRIGGER REGULATORS’ MISUNDERSTANDING OF REVERSE MERGERS

Stock short sellers: crying wolves in the sheep’s skin

By 2011, investors rotated out of Chinese stocks into recovering U.S. companies. Illegal stock short sellers quickly “cried fire in a theater” and built huge short positions against Nasdaq-listed, China based companies to profit from declining share prices. False rumors spread by short sellers brought down the entire China space. Egregious stock short sellers fabricated identities, published false “research reports” on Chinese companies, misled SEC and DOJ regulators. After many millions in illicit profits, the same stock short sellers turned into “whistleblowers” to hide their dirty tracks. Like cat fish feeding in the bottom of a murky pond, some poorly educated SEC staffers took the baits: Steven Susswein and Cheryl Crumpton were among the dumbest – neither has worked a day in the private sector and neither understands China other than yelling out “Kung Pao Chicken” off a menu in Chinatown.

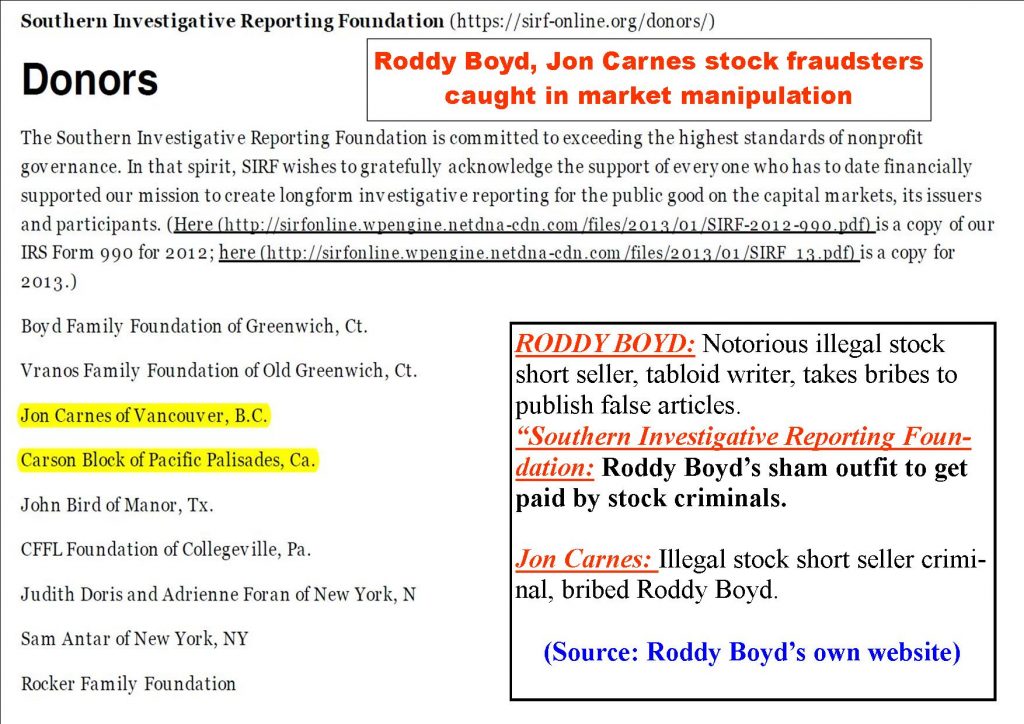

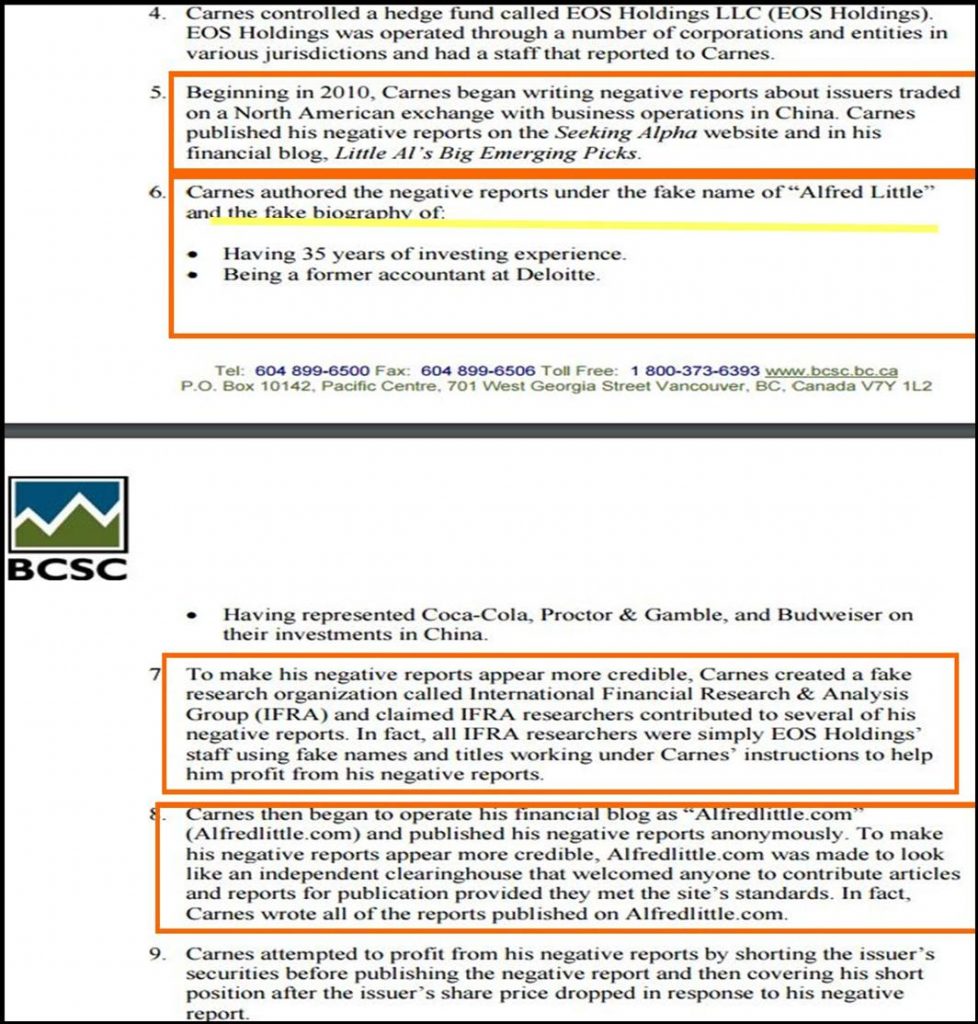

The most notorious short seller market manipulators are “fatty boy” JON CARNES, under a fake name “Alfred Little,” and his mouthpiece – tabloid writer Roddy Boyd, who was bribed by Jon Carnes to write false stories, exposed in the evidence. Between Jon Carnes‘s false reports and Roddy Boyd’s repeat of the same lies in chat rooms as well as his sham “Southern Investigative Reporting Foundation” – a money laundering outfit funded by a slew of stock short sellers, these market manipulators made millions taking investors to the cleaners. Meanwhile, Steven Susswein and Cheryl Crumpton were busy collecting their lousy paychecks and did absolutely nothing to rein in these market “wild boars.”

Read more: SEC Suit Against Lawyer William Uchimoto Is A Political Hatchet Job

Steven A. Susswein, short seller stock fraud, bribery

“STEVEN A. SUSSWEIN is my guy inside the SEC,” the stock criminal Jon Carnes “proudly” announced on his twitter, disguised as “Alfred Little” – a fake name.

Who is STEVE SUSSWEIN? A quick Google search turns up troubling backgrounds on Steven A. Susswein as a notorious, corrupt bureaucrat and a short seller promoter.

STEVE SUSSWEIN is a typical government waste, someone who enjoys a stress-free, comfortable lifestyle achieving absolutely nothing, until he got his corrupt hands dirty.

Read more: TABLOID WRITER, FRAUDSTER RODDY BOYD IMPLICATED IN MULTIPLE FRAUDS

Roddy Boyd, Jon Carnes indicted for fraud, Steve Susswein implicated

In 2014, Steven Susswein’s stock fraudster buddies Jon Carnes and Roddy Boyd were indicted by Canadian regulators. Law enforcement charged Roddy Boyd and Jon Carnes with committing massive securities frauds – orchestrating “short and distort” campaigns with fabricated identities and brutally robbed investors out of tens of millions of dollars. According to the indictment against Jon Carnes, law enforcement charged Jon Carnes and Roddy Boyd with manipulating the markets. The government says:

“Jon Carnes and Roddy Boyd authored the negative reports under the fake name of ‘Alfred Little’ and the fake biography of: Having 35 years of investing experience. Being a former accountant at Deloitte. Having represented Coca-Cola, Proctor & Gamble, and Budweiser on their investments in China – It was all fabricated, totally made up…” The evidence is here:

Steven A. Susswein, cover-up for short sellers, falsely accused Bill Uchimoto

Sitting in his small office cubicle, Steve Susswein was worried about the captured stock criminals Jon Carnes and Roddy Boyd. They could sell out Steve Susswein as an abettor of the exposed stock fraud. Kun Huang, a lieutenant in the Jon Carnes crime family spent two years in prison for the same massive fraud against America’s public companies.

Read more: STOCK SHORT SELLER JON CARNES CRIME FAMILY LANDED 2 YEARS IN PRISON

To cover up for Jon Carnes and Roddy Boyd‘s dirty tracks, the corrupt SEC staffer Steven A. Susswein blamed Chinese advisers and set his eye on lawyer William Uchimoto. In roaring revenge against the Chinese, Steven Susswein fabricated an “enforcement case” against Bill Uchimoto. Steven A. Susswein recruited an Alabama woman Cheryl Crumpton to join his “ISIS-styled” crusade against Bill Uchimoto – smeared Mr. Uchimoto in public. Cheryl Crumpton is an obscure SEC enforcement staffer from the deep south Alabama, the home of the “Black Lives Don’t Matter” movement. “This made up SEC is about race and racial discrimination,” Uchimoto said.

Retaliation against William Uchimoto, SEC ruling against racism, “Nasdaq Spirit”

WILLIAM UCHIMOTO fought back: “The SEC accusation against me was a surprise and pure nonsense.” With his name in the mud by Steven A. Susswein and Cheryl Crumpton, Uchimoto told reporters with American Lawyer magazine.

“Steven Susswein and Cheryle Crumpton outright lied about the facts,” Uchimoto said about the SEC’s complaint. “I got swept into something so the SEC staffers could have some scalps in retaliation…”

William Uchimoto was right. In 2013, the Nasdaq was “bitch-slapped” by the SEC for its wrongful delisting of China-based CleanTech Innovations. Nasdaq claimed CleanTech, a Uchimoto client had violated a fabricated Nasdaq listing rule called the “Nasdaq Spirit.” A racist Nasdaq staffer Michael Emen was caught on the rape saying Nasdaq had delisted CleanTech to “send a message to the world… the 1.4 billion Chinese can’t cheat the Nasdaq…” Forbes Magazine reported that Bill Uchimoto was a key witness to the SEC, which led to the SEC’s landmark ruling against the Nasdaq – an institutional racist.

Read more: ED KNIGHT, NASDAQ GENERAL COUNSEL CAUGHT IN RIGGING NASDAQ LISTING SCANDAL…

Were Steve Susswen and Cheryl Crumpton doing the bidding for Nasdaq’s retaliation? Was Bill Uchimoto the ‘gift of scalp’ to the notorious Nasdaq General Counsel Ed Knight? Was William Uchimoto singled out by the SEC imbeciles because he was a witness against the Nasdaq? That’s exactly what has happened in a racially divided country where government bureaucrats like Cheryl Crumpton and Steven Susswein run wild.

Read more: DISGRACED NASDAQ OFFICIAL MICHAEL EMEN REVEALS NASDAQ AS AN INSTITUTIONAL RACIST, ED KNIGHT IMPLICATED…

William Uchimoto, courageous SEC lawyer fights SEC abusers

Bill Uchimoto told the American Lawyer magazine that despite his stature as an attorney, the SEC never sent him a “Wells Notice” — a common practice of the SEC warning of an impending action. Wall Street Journal says the SEC enforcement wins half of its claims in federal courts. What about the other half” They end up in smoke as total bullshit. Win or lose, a defendant’s reputation is forever tarnished.

“Regulatory abusers like Steven Susswein and Cheryl Crumpton hide behind government immunity like skunks and earthworms,” critics say. “Who is holding them accountable? The courts and the media.”

Read more: OP-ED: CAN’T FIND CHINA ON A MAP? RACIST SEC LAWYER DEREK BENTSEN HUNTS ASIAN SCALPS

“Nasdaq is a $12 billion country club for millionaires. It’s not a government agency,” said a market expert. “Steve Susswein and Cheryl Crumpton are prosecuting a 10 year old case to protect their millionaire friends on Wall Street so they can get some plush jobs someday. It’s a shameless revolving door.”

SEC “made up evidence” against Bill Uchimoto, court filings reveal

Sources have confirmed William Uchimoto and two other attorneys plan to sue Steven Susswein and Cheryle Crumpton. Bill Uchimoto’s attorneys filed motions with the highly regarded New York federal judge Kevin Castel to dismiss the frivolous SEC lawsuit, quoting from court papers:

“The Nasdaq Rule 4310 (c)(6) did not address how holders came to possess their shares (e.g., through trades, gifts, or inheritance),” the court documents say. “Nor did the Rule distinguish between shares held in registered form (certificates) and shares held in ‘street name’ (in brokerage accounts).”

Steven Susswein and Cheryle Crumpton deliberately fabricated a “Nasdaq rule violation” against Bill Uchimoto. On June 8, 2016, Judge Castel granted Uchimoto’s motion to dismiss the SEC’s charges.

Read more: MELISSA HODGMAN, Racist SEC Enforcement Staffer Wants Pay Raise, Not the Truth

New York Law Journal has reported William Uchimoto has filed Rule 11 sanctions against the abusive SEC staffers MELISSA HODGMAN, CHERYL CRUMPTON, DEREK BENTSEN, PATRICK FEENEY, STEVEN SUSSWEIN, JOSHUA BRAUNSTEIN.

Calls to the SEC Inspector General’s office were not immediately returned. While William Uchimoto suffers irreparable harm to his otherwise stellar reputation, neither Steve Susswein nor Cheryl Crumpton is willing to voice their side of the story. A spokesperson for the SEC declined to comment. Readers wonder why they are hiding from the American public like rats…

“The SEC enforcement process lacks transparency, and it’s totally rigged.” said Dallas billionaire Mark Cuban who recently experienced his own hell defeating an SEC suit. Mr. Cuban is right. It’s time to expose these regulatory abusers and get these imbeciles out of our government.

THE LATEST UPDATES: A New York Southern District federal judge ordered a historic “Franks Hearing” on Jan 23, 2017 to investigate the extent rookie FBI agents Matt Komar, Thomas McGuire have fabricated search warrant evidence, misled federal judges in gross violations of a citizen’s constitutional rights: Review the case summary and record! This will be an open court, public hearing. The media and the public are encouraged to come and report on this event. It’s time to #DrainTheSwamp! Lies told by SEC staff Melissa Hodgman, Cheryl Crumpton, Steven Susswein, Derek Bentsen will be exposed.