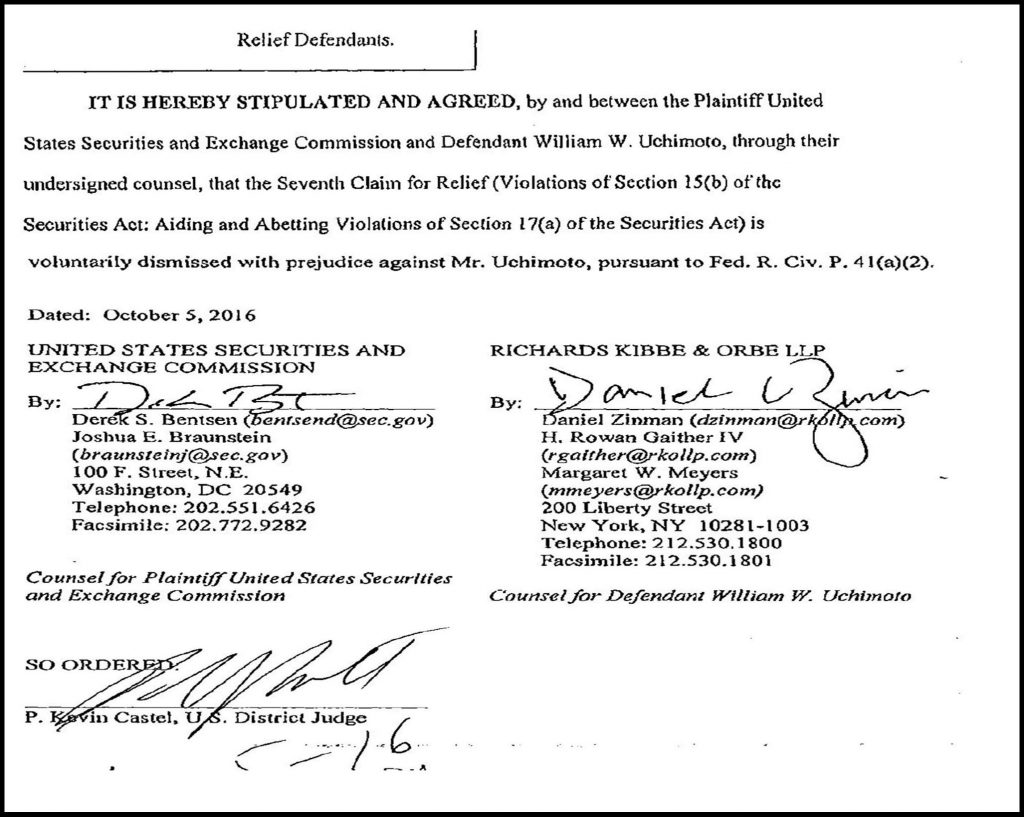

THE LATEST UPDATES: On March 27, 2017, a New York federal judge DISMISSED all SEC charges against American hero lawyer WILLIAM UCHIMOTO. The SEC regulatory rapists Derek Bentsen, Steven Susswein, Melissa Hodgman, Cheryl Crumpton were exposed as racists.

Editor’s Note: Two days after this Op-Ed was published, the Securities and Exchange Commission (SEC) dropped a major fraud charge against lawyer William Uchimoto. This article was distributed to news outlets worldwide as well as to presidential candidates Clinton and Trump. Trump campaign responded to TheBlot Magazine: “President Trump will eliminate 70% of the overregulation, including at the SEC.” The SEC’s “regulatory rapists” Derek Bentsen, Steven Susswein, Cheryl Crumpton have ruined the life of a highly respected Asian American lawyer William Uchimoto, in the same anti-China harassment and idiocy exposed by the New York Times, called out by TheBlot Magazine’s dear friend journalist Ronny Chieng with The Daily Show as “ignorant sack of shit.” Now the spotlight is on exposing the regulatory rapists Derek Bentsen, Steven Susswein, Cheryl Crumpton. These abusers must be exposed for the sake of public interest and justice. In June 2017, the SEC, DOJ’s fabricated, racially charged, politically motivated case crumbled: The New York Times reported: Revered federal judge ruled Benjamin Wey’s constitutional rights were grossly violated; Forbes magazine reported: Benjamin Wey won a landmark victory over fake charges, exposed government abuses of power; The New York Law Journal says federal court declared fake evidence against financier Benjamin Wey “unconstitutional…” Stanford University says “Chinese reverse mergers outperform U.S. counterparts,” echoed by CNBC and Reuters; NY Law Journal confirms Federal Judge Alison Nathan Defends Constitutional Rights; The New York Times reported Made-up case against Wall Street financier follows government’s pattern of fabricated cases… Who will pay a steep price for such gross violations of a citizen’s legal rights and the ensuing massive financial losses? Stay tuned…

More In-depth:

MELISSA HODGMAN, Racist SEC Enforcement Staffer Wants Pay Raises, Not the Truth

Read more: MELISSA HODGMAN, SEC ENFORCEMENT LAWYER HAD JOB PROMOTION RIDING ON ‘ASIAN SCALPS,’ LAWSUIT SAYS

UPDATES: In March 2017, the SEC’s fraudulent claims against WILLIAM UCHIMOTO was DISMISSED by federal judge P. KEVIN CASTEL. The racist SEC enforcement MELISSA HODGMAN, DEREK BENTSEN, CHERYL CRUMPTON, STEVEN SUSSWEIN, JOSHUA BRAUNSTEIN, PATRICK FEENEY were exposed:

DEREK BENTSEN, an obscure SEC “enforcement lawyer” that no one has heard of has just landed a new gig in a New York federal court – touting himself as an “expert” on China. Like a wild boar roaming over Virginia’s mountains, the mysterious SEC lawyer Derek Bentsen is making bizarre allegations chewing off the heels of prominent Asian Americans. What about Derek Bentsen’s knowledge of China or the Asian business practices? None. Zero.

Read more: HOW TO WIN A FABRICATED CASE? SEC LAWYER DEREK BENTSEN KNOWS: DUPE A FEDERAL JUDGE FIVE TIMES

A “massive” $30 fraud, meet the SEC’s regulatory rapist Derek Bentsen

While pursuing a racially charged, politically motivated SEC case against the well-known lawyer William Uchimoto, whose father is the most decorated Japanese American soldier in World War Two, the SEC staffer Derek S. Bentsen has accused Uchimoto of “assisting and abetting” a multi-million dollar “China fraud.”

The imbecile SEC lawyer DEREK BENTSEN (Tel: 202-551-6424, email: bentsend@sec.gov. Source: Court filings, public records) alleges Uchimoto received a gift certificate from a Chinese friend 10 years ago during Christmas, described in Derek Bentsen’s own words as “William Uchimoto’s incentive and motive to commit a massive cross-border SEC fraud.”

Read more: INVESTIGATIONS: HOW NASDAQ’S WILLIAM SLATTERY, FINRA’S ROBERT COLBY LIED TO THE FBI, DUPED THE GOVERNMENT

The vague SEC conclusory charge without any supporting evidence is like reading the tea leaves behind a smoke screen. What’s lacking in specifics is an answer to a common-sense question: What’s the worth of the “gift certificate” Uchimoto received that has caused him to ruin his spotless, 35 year legal career as a top Asian American lawyer? The SEC’s answer was like an earthquake: $30!

“This is Derek Bentsen and the SEC’s logic: A top American lawyer who makes over $1 million a year gave all that up in order to ‘abet a fraud’ so he could make $30.”

Derek Bentsen, CHERYL CRUMPTON think so: “Bill Uchimoto committed a massive SEC fraud because he received a 100-share stock certificate worth $30 about ten years ago,” Derek Bentsen announced to the world. Ah? Really?

“Calling the SEC lawyer Derek Bentsen ‘poorly informed’ is just too kind! It’s a huge understatement of this man’s extremely limited intellect as a damn racist!”

Since $30 sounded like a fortune for Derek Bentsen, Uchimoto must have spent the $30 certificate the moment he received it, right? Wrong! It’s still sitting in Uchimoto’s office as of October 2016, after 10 years. Uchimoto said he never cashed the gift certificate because it was a souvenir from a friend.

“The SEC and Derek Bentsen must think the American public is full of idiots like them. A $30 gift certificate is hardly a fraud on anyone, let alone a ‘massive SEC fraud’ alleged by Derek Bentsen.”

More In-depth:

Read more: FRAUD, LIES, SEC STAFF STEVEN SUSSWEIN, CHERYL CRUMPTON SLAMMED IN FEDERAL COURT

SEC lawyer Derek Bentsen, an “ignorant sack of shit?”

Readers can understand Derek Bentsen’s low pay grade as a useless bureaucrat may not be something he wants to brag about. But does it sound fair for the government waste Derek Bentsen to abuse his power and rape Uchimoto’s reputation with a $30 bullshit charge – blown up like a hot air balloon over some SEC Wawa land?

“Is the SEC lawyer Derek Bentsen plain stupid or is this kid a damn racist abuser? Bill Uchimoto knows the answer. So do the media and the American public.”

In a September 2015 interview with the American Lawyer magazine, Bill Uchimoto lashed out at SEC’s dirty tactics and racial discrimination against him. Bill Uchimoto told reporters that he got a subpoena and was deposed by three SEC enforcement lawyers in 2014. “I could tell they had prejudged this,” he said to reporters.

“I think the SEC outright lied about the facts,” WILLIAM Uchimoto told reporters. “I got swept into something so they could have some Asian scalps.”

Derek Bentsen, can’t find China on a Map, made up a bullshit market manipulation case

Derek Bentsen is not shy about making shit up in the federal court, lying in the face of the highly intelligent federal judge P. Kevin Castel. Investigations revealed Bentsen colluded with two notorious and disgraced SEC “dead meat” bureaucrats Steven Susswein and Cheryl Crumpton, and completely fabricated an SEC case against Bill Uchimoto.

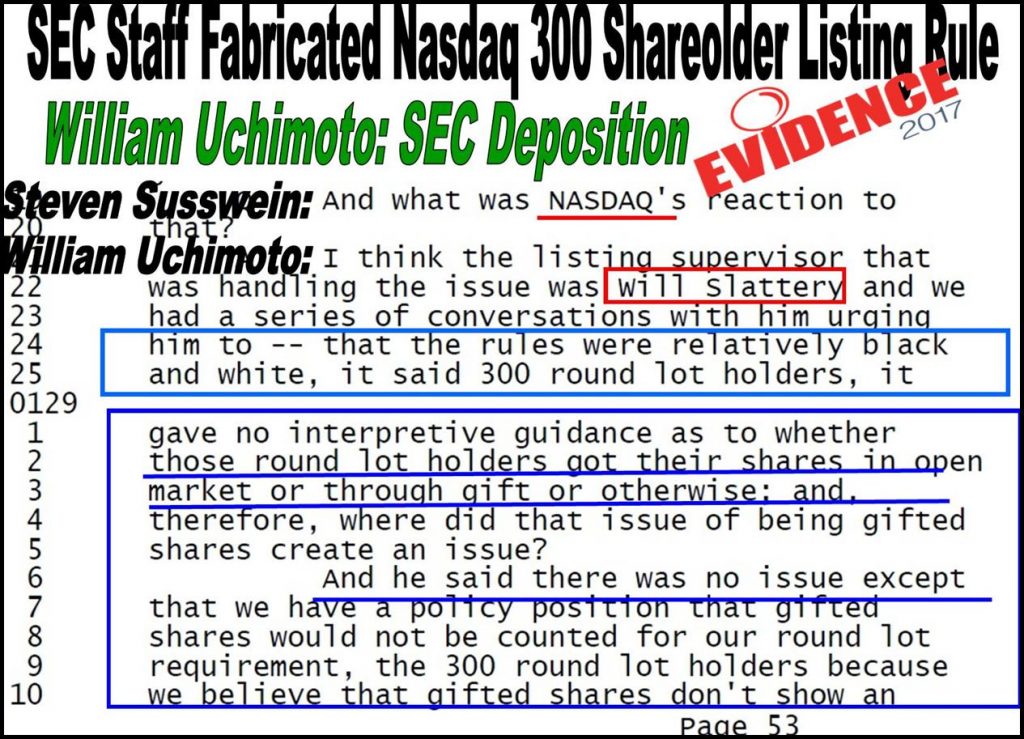

Read more:SEC Staffer STEVEN SUSSWEIN Fabricated Law on Stock Gifting

Such bureaucratic stupidity didn’t end there. These three “SEC musketeers” made another even more idiotic claim against Bill Uchimoto in a September 29, 2016 court filing before federal judge P. Kevin Castel.

Pointing fingers at William Uchimoto, Derek Bentsen could hardly hold his foul breath:

“… his co-defendants would convince the client companies to enter into “lock up” agreements that prevented the management from trading their shares for a period of time…This control allowed easily manipulate the market for those securities and profit from the scheme.”

A made up “market manipulation” case, teaching the dumb SEC bigot Derek Bentsen basic Chinese laws

It’s hard to teach a dumb and racist bigot about international law, but let’s just take a shot at Derek Bentsen with some basic Chinese government regulations:

Under the Chinese law, shares owned by founders/management are automatically “locked up,” prohibited from trading for at least 3 years from the date when their companies get listed on a stock exchange. The rule applies to China-based companies listed anywhere in the world since many of them have Chinese shareholders. The voluntary “lock up” of Chinese founder shares for 3 years is literally the Chinese legal requirement – the black letter Chinese law! In the U.S, a similar requirement exists under the SEC’s own Rule 144 which demands insiders maintain a 2-year share lock up. It’s exactly the same concept. Somehow this normal business became “illegal activity” when China-based companies are involved. Pure racism? Yes, that’s also called an “ignorant sack of dumb shit,” exposed by our journalist friend Ronny Chieng in The Daily Show.

A cursory reading of The Wall Street Journal teaches Derek Bentsen and his fellow SEC retards the same basic knowledge:

In a December 2015 Journal article titled “Chinese Companies Are Trapped in IPO Logjam,” the Wall Street Journal pointed out the same Chinese law: “… the Chinese company’s ‘control investor,’ usually its founders, can’t sell shares for three years…”

“The 3 year share lock-up rule under Chinese law is so well known, so basic, even someone with an IQ of 40 (almost a complete retard) in China would know that. But it was too complex for the uneducated SEC folks Derek Bentsen, Steven Susswein and Cheryl Crumpton, Melissa Hodgman, Joshua Braunstein to comprehend.”

By entering into share lock-up agreements, a Chinese company and its founders reap many benefits. In addition, those share lockup arrangements received unanimous board approvals, passed independent auditor reviews, received blessings from their own lawyers, applauded by investors, had management’s own signatures, made repeated disclosures in their SEC filings, and the company successfully raised over $100 million each to spend freely – directed by the same company founders/managers/board members themselves…

Is obeying the law somehow becoming “market manipulation”? For the imbecile SEC bureaucrats, common sense is just so outside of Derek Bentsen’s limited brain power…

“Did this curious SEC lawyer Derek Bentsen ever bother to read a single Chinese law book before he choked himself in complete ignorance, humiliated himself in public filings with false allegations against the Chinese?”

Or is Derek Bentsen so shameless that he’s just happy being in existence as a true retard and a regulatory rapist? Perhaps both.

Read more: Fraud SOUTHERN INVESTIGATIVE REPORTING FOUNDATION, SIRF, RODDY BOYD in FBI Crossfire

Whatever BS Derek Bentsen may use to defend his stupidity, the collateral damage from his regulatory rape is irreversibly the same: William Uchimoto’s stellar reputation was shredded by Derek Bentsen.

Derek Bentsen, Shallow Character, no ethics

Derek Bentsen’s personal profile on LinkedIn could hardly fill the large gaps between the embarrassing facts and his false allegations against Bill Uchimoto. In 2008, while Uchimoto was at the top of his career advising companies suffering from a historic financial crisis, Derek Bentsen was a kid barely out of puberty.

According to his own published bio, Derek Bentsen’s “China experience” was never much beyond someone stepping outside the DC Chinatown. Bentsen’s only overseas experience was a non-degreed, bullshit “diploma” from a third tier UK school on “War Studies” (2009-2011), according to his own published LinkedIn profile.

While no one blames Derek Bentsen for having contributed nothing to Britain’s victory over Nazi Germany – when William Uchimoto’s father was a renowned Japanese American war hero, Derek Bentsen, the kid out of the comic book of “War Studies” enjoying making shit up fighting an unprovoked war against the Chinese.

While waving Uchimoto’s “Asian scalp on a pole” to advance his largely failed career as a wasted bureaucrat, Derek Bentsen can’t even find China on a map, let alone making credible claims against fellow Americans with decades of experience actually doing business with China.

“Derek Bentsen exhibited shallow character of a human being – a racist, ignorant mind filled with prejudice and jealousy, immersed in pure speculation spitting out nonsense in a wild goose chase.”

More In-depth:

Robert Colby, FINRA General Counsel Rigs FINRA NAC Kangaroo Court

It’s easy to make allegations against Asian Americans or even Chinese companies. Let’s face it: the Asians are a quiet group: they don’t argue, they never fight back, they take care of their own business and they honestly believe government bureaucrats like Derek Bentsen, Steven Susswein or Cheryl Crumpton are decent people. WRONG!

“Unfortunately, for the racist SEC bureaucrats Derek Bentsen, Steven Susswein and Cheryl Crumpton, China only exists in unlawful obscurity – somewhere in the galaxy.”

Derek Bentsen, Very stupid people must be fired – Donald Trump

What are Derek Bentsen’s credentials for litigating a case involving China and the highly complex Asian finance? He has none.

“Derek Bentsen has never been to China. He can’t utter a single Chinese word beyond shouting out ‘Kung Pao Chicken’ at a $5 “all-you-can-eat” buffet in DC’s Chinatown…”

Read more: SEC STAFFER STEVEN SUSSWEIN CAUGHT IN MADE-UP SEC CLAIM: GIFTING STOCKS ILLEGAL IN AMERICA?

“Our government is run by very stupid people. They have no clues about China,” Donald Trump is right! We just witnessed the same nonsensical, reckless behavior in Derek Bentsen, Steve Susswein and Cheryl Crumpton’s outrageous regulatory rape of fellow Americans. Let’s hope President Hillary Clinton or President Trump will dump these government wastes into a trash can. These dumb rats stink!

“For these racist SEC bigots, it’s a ‘win or win’ ball game, facts don’t matter! When they lose, they hide behind government immunity like rats still collecting their taxpayer funded paychecks.”

Invitation to The Daily Show, Hiding like rats

Uchimoto maintains he did not deceive the Nasdaq because they were aware of the gifts of shares made shareholders who had bought and owned the shares. Furthermore, he said, Nasdaq’s Director of New Listing Andrew Hall had told him these gifted shares could be legitimately counted toward the 300 shareholder requirement if the shares were placed in a brokerage account and eligible to be traded.

On July 8, 2016, prosecutors in New York’s Southern District finally conceded in a court filing before the highly regarded federal judge Alison Nathan: “It does not claim that NASDAQ or any other entity had in place a formal rule banning the gifting of shares in connection with a listing application.”

At press time, the SEC has declined to comment on this story. Derek Bentsen has quickly removed his picture from the internet.

Americans know: “Truth hurts, media spotlight sanitizes.”

These reckless SEC abusers must be held accountable within the law. The drum beat is on Derek Bentsen…

The CBS journalist Ronny Chieng is right:

“Let’s get these SEC folks on the Daily Show and let them talk about their case against the Asians. Will they come?”

We will gladly invite these SEC retards to The Daily Show! So far, none of them could be located. No accountability or transparency? Yikes! That’s the familiar SEC staff jack off…