RICK KETCHUM, the chairman and CEO of the Financial Industry Regulatory Authority (FINRA) known as FINRA testified in front of congress recently. The On The Record interview was part of congressional oversight hearings of the Financial Industry Regulatory Authority, known as FINRA.

BREAKING NEWS:

“Rick Ketchum is the highest highest paid government employee in America. Rick Ketchum is paid $300,000 a MONTH. The average American family of four makes $45,000 a YEAR…”

Rep. Scott Garrett began the interview by telling Ketchum many people view FINRA as a “Quasi-Government Regulator” or “deputy Securities and Exchange Commission.” He went on to add that “many people may argue that it does not even resemble an Self Regulatory Organization” (SRO).

At the hearing, Ketchum defended FINRA’s extralegal investigative, enforcement and punitive actions by saying that “the balance is correct today” and that FINRA is in fact not over-regulating small broker dealer businesses. Did Rick Ketchum just lie to Congress? Experts say he did. Industry research shows the number of FINRA licensed investment brokerage firms declined from more than 7,000 a decade ago to less than 4,000 today. Meanwhile, the nation’s large brokerage houses are getting larger and are “too big to fail.” The massive job loss in the FINRA regulated brokerage industry was attributed to the closing of small brokerage firms by FINRA bureaucrats.

More:

FINRA CEO RICHARD KETCHUM’S INDEFENSIBLE TANGO BEFORE CONGRESS

Read more: FINRA CEO RICK KETCHUM PLAYED LIKE A FOOL, SPONSORS RACISM, ABUSER JEFFREY BLOOM CAUGHT PANTS DOWN

But Richard Ketchum has a good reason to defend FINRA. He was paid more than $3 million last year as the titular head of the in make only non-profit Organization. Not too shabby for a year’s pay as the highest paid U.S. government employee. Ironically Rick Ketchum seems to get paid better and more money depending on how many brokers he runs off American’s financial services firms.

But it didn’t begin with Richard Ketchum or end there, FINRA has a long history of regulatory abuses, over regulation and discrimination since it was created in 2007 when the National Association of Securities Dealers (NASD) merged with the New York Stock Exchange (NYSE). The NASD was spun off from the NASDAQ, which is a $10 billion profit machine owned by Wall Street fat cats – whose former Chairman is the king of Ponzi scheme – Benie Madoff, overseen by Ed Knight – Nasdaq’s General Counsel worth at least $100 million. Read more: ED KNIGHT, NASDAQ GENERAL COUNSEL CAUGHT IN RIGGING NASDAQ LISTING SCANDAL…

Read more: PROFESSOR CHRIS BRUMMER, AN UNQUALIFIED CFTC NOMINEE IN A SECRET DARK CLOSET.

The latest episode and decision handed down by FIINRA on Dec. 29, 2014 came in total disregard of the facts, U.S. law and without any allegations of harm caused to customers. Though no complaints from customers were were cited, FINRA still singled out black brokers Talman Harris and William Scholander and barred them from the securities industry for life. Harris and Scholander have appealed to the the Securities and Exchange Commission (SEC) of the wrongful FINRA decision: SEC rebukes FINRA racist decisions, Talman Harris Exonerated.

“For almost 20 years, Talman Harris and William Scholander have maintained spotless regulatory histories as patriotic, American investment professionals. FINRA singed them out because they have the wrong skin color – BLACK.”

Read more: SEC filing rebukes FINRA’s racist decisions, Talman Harris was exonerated in FINRA complaint.

Harris and Scholander own a small business and are investment brokers with a clean regulatory history. For nearly two decades, the two professionals never had a single customer complaint about their business, ethics, or acumen.

More:

Robert Colby, Alan Lawhead, FINRA Defend Rape Charges Claiming ‘Regulatory Immunity’

Talman Harris is an American who immigrated to New York from Jamaica as a teenager, becoming a proud American citizen in April 2014. William Scholander was born in Brooklyn, New York and has worked equally hard to create an esteemed career in the securities industry for 20 years.

Read more: FINRA BARRED TWO INNOCENT BLACK BROKERS BASED ON BS, RACISM, TRASHES THE AMERICAN CONSTITUTION

Their appeal to the SEC is likely to take a year or more, during which their business would be destroyed unless the SEC issues a stay of the order pending the appeal.

“We will take the FINRA prejudice to the U.S. Supreme Court if needed,” vows Talman Harris and William Scholander. “This is not just a fight against FINRA tyranny, this is about an answer from FINRA whether ‘Black Lives’ Matter!”

Repeated “Rubber Stamp” Abuses by FINRA Pose a Severe Public Policy Threat To American Business

FINRA is a “non-profit” quasi-governmental organization whose CEO, Richard Ketchum, is paid $300,000 per month in salary and benefits. FINRA controls over 600,000 investment professionals. Sanctions of these professionals are rubber stamped nearly 100% of the time within FINRA’s murky administrative appeal process, with little accountability, transparency, or oversight.

Read more: CHICAGO STOCK EXCHANGE SALE TO CHINA ENDS RACIST NASDAQ MONOPOLY ON LISTINGS

FINRA staffer Jeffrey Bloom has harassed Harris and Scholander with repeated and frivolous inquiries for over seven years, and there are indications that this case was racially motivated.

Egged on by fraudulent market manipulators, Jeffrey Bloom also instigated the wrongful NASDAQ delisting of Cleantech Innovations, Inc. After Congressional inquiries to the SEC, and legal action by former Senator Arlen Spector and William W. Uchimoto, Esq., the SEC commissioners unanimously reversed the delisting in 2013. (Forbes: “In Rare Move, SEC Reverses Nasdaq’s Delisting Of Chinese Company”).

More:

Read more: CHRIS BRUMMER, GEORGETOWN LAW SCHOOL PROFESSOR CAUGHT AS A RACIST FINRA LACKEY

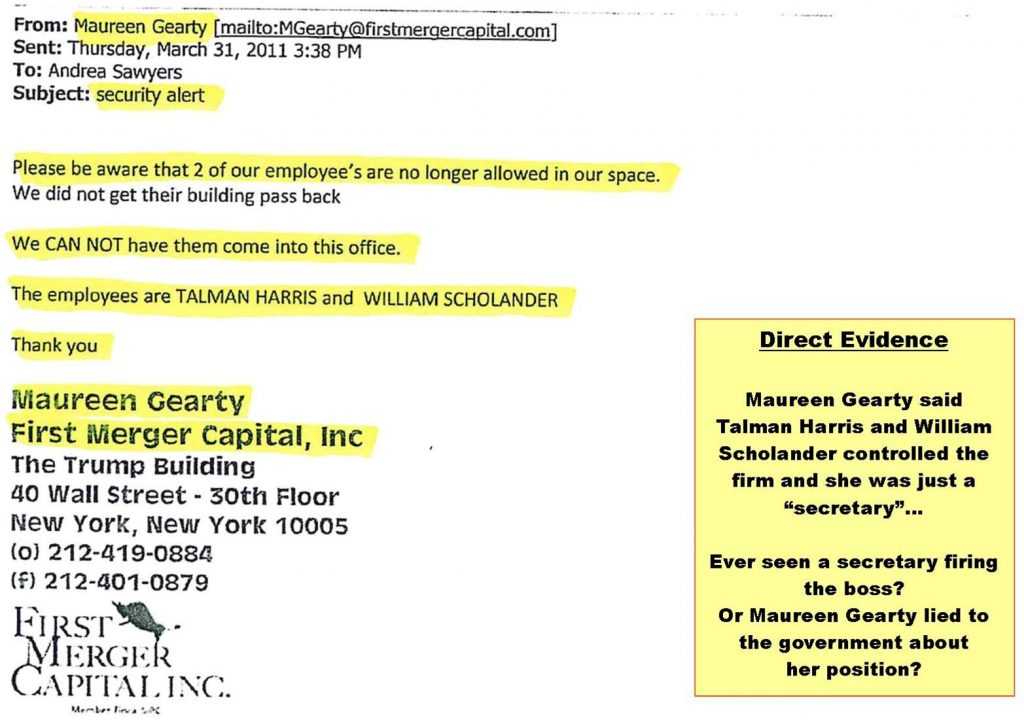

FINRA barred Harris and Scholander after failing to catch a Ponzi scheme that was run by FINRA’s star witness a former assistant to Ronen Zakai, Maureen Gearty.

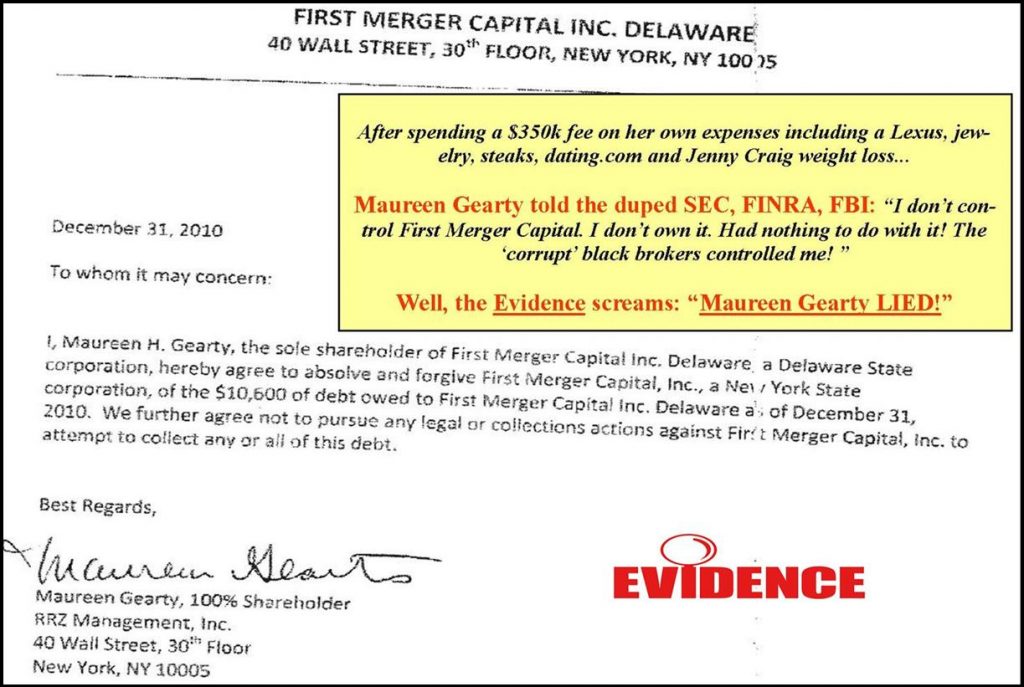

Gearty worked intimately with Zakai as they together controlled a brokerage firm called First Merger Capital (FMC). Gearty later admitted that she was in sole control of a shadow FMC bank account into which an issuer wired her a consulting fee of $300,000.

In 2010, Zakai and Gearty persuaded Harris and Scholander to work as brokers at FMC under their management. At no time did Harris or Scholander take any supervisory role at the company.

Read more: FINRA SUPPORTS FINRA NAC MEMBERS, SPONSORS RACISM, CHRIS BRUMMER FRAUD

Gearty and Zakai then proceeded to create a Ponzi scheme called the “Social Innovation Fund,” to defraud investors out of their money. The fund was expressly co-managed by Geary and Zakai who by this point had begun to have an affair in addition to their business relationship. Harris and Scholander vehemently refused to allow their clients to buy into the fund as they both suspected it was a fraud. When she got the news, likely from Zakai that the brokers were not offering the fund to their clients and encouraging other brokers to do the same Gearty swiftly terminated them from FMC. Backed by documents asking Zakai to not contact their clients, Harris and Scholander never sold the Fund to anyone.

FINRA did in fact investigate Gearty and Zakai but failed to find that they were operating an ongoing Ponzi scheme, similar to how billion-dollar fraudster Bernie Madoff had conned regulators in the past though this amount was in the millions.

More:

Read more: AEGIS CAPITAL FIGHTS BACK AT FINRA BLACKMAIL, RACISM

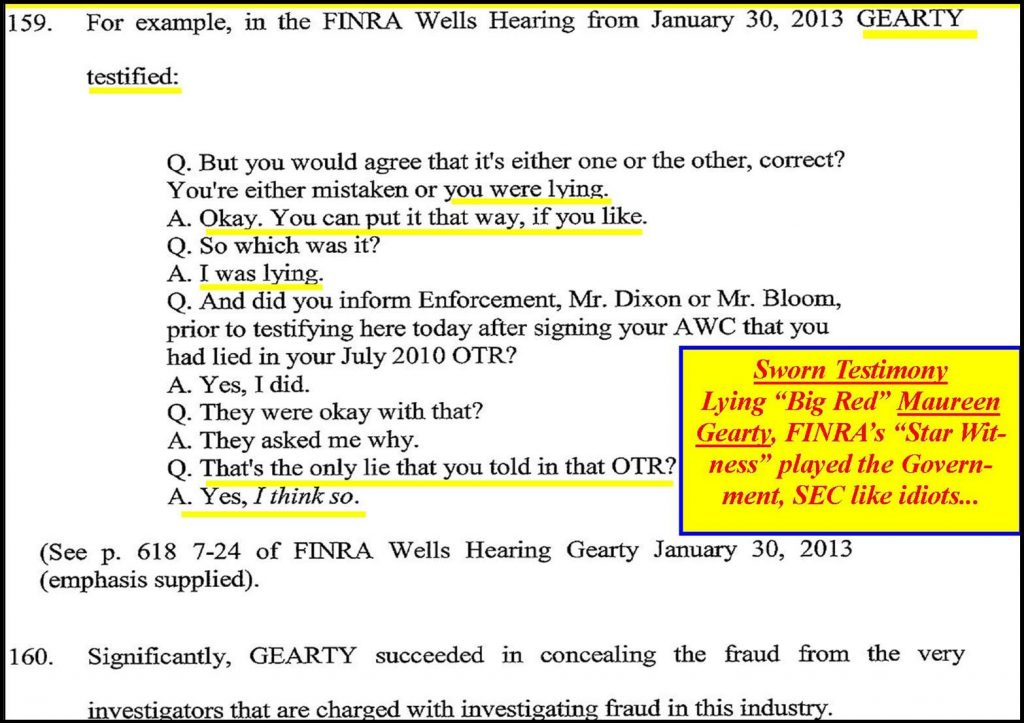

On several occasions, Harris and Scholander urged FINRA to investigate Gearty and Zakai. Shockingly, FINRA staffer Jeffrey Bloom disregarded their tip and made a deal with Gearty to avoid fining her. During an enforcement hearing Gearty agreed to testify that contrary to clear evidence, the consulting fee she received was intended for the benefit of Harris and Scholander

The FINRA hearing officer found that Gearty’s testimony was the sole credible source of the facts used to establish fraud on the part of the brokers even though she admitted that she had lied under oath and changed her testimony at least multiple times:

Manhattan District Attorney Cyrus Vance caught what FINRA missed and indicted Zakai. In October 2014 Zakai was convicted of 11 felony charges including grand larceny and fraud, proving Harris and Scholander right that it was a fraudulent scheme and they were correct to shield their clients from investing. Zakai was sentenced to four years in prison for running the massive Ponzi scheme through the fund at FMC.

Read More: FINRA LACKEY, GEORGETOWN LAW PROFESSOR CHRIS BRUMMER IMPLICATED IN MULTIPLE FRAUDS

Alan Lawhead, Robert Colby, FINRA NAC, the Corrupt FINRA Watchdog is Full of Fleas

Just months later FINRA nevertheless barred Harris and Scholander from the industry for life for failing to disclose the fee Gearty received despite clear testimony and evidence that the payment was solely controlled and used by her and Zakai, and was alone for their benefit.

2 Comments

Leave a Reply