FINRA IS RUN BY ABUSERS. Talman Harris, a black American hero, financial adviser and a proud African American on Wall Street

TALMAN HARRIS is an accomplished black stockbroker in New York. A naturalized American citizen, Talman Harris has had a dream since childhood – becoming a financial adviser as a member of FINRA, the powerful and racist Financial Industry Regulatory Authority and manage money for his friends and family.

BREAKING NEWS:

As a broker in the world of FINRA, Talman Harris is doomed from the start: he is a black man in a world of white elites

FINRA is a government agency that licenses investment advisers and stockbrokers in the United States. For almost two decades, Talman Harris worked hard for his clients. He followed the law and his successful track record was hailed as one of the best on Wall Street.

“For more than 17 years, Talman Harris has maintained a spotless regulatory history without a single customer complaint.”

More:

Robert Colby, FINRA Chief Legal Officer Fell on Regulatory Rape Charge

Throughout 17-year career, Talman Harris has produced admirable investment returns for his clients. And he never received a single customer complaint – an extremely rare record for professionals on Wall Street. “Talman Harris is an intelligent professional well versed in securities regulations, ” said David Johnston, a compliance officer. “Talman Harris is well respected by his colleagues and clients.”

For years, Talman Harris has been an active member of the “Black Lives Matter Movement.” But in the eyes of FINRA or Chris Brummer, blacks lives don’t matter.

Read more: INVESTIGATIONS: HOW NASDAQ’S WILLIAM SLATTERY, FINRA’S ROBERT COLBY LIED TO THE FBI, DUPED THE GOVERNMENT

READ MORE: GEORGETOWN PROFESSOR CHRIS BRUMMER SUED FOR FRAUD, BROKER TALMAN HARRIS FIGHTS FINRA NAC ‘MEAT GRINDER’

Lawsuit against FINRA Regulatory Abuses

In June 2015, Talman Harris filed a complaint with the Securities and Exchange Commission against FINRA, its racist staff Jeffrey Bloom and Chris Brummer. In the complaint, the SEC filing strongly rebukes FINRA’s racist decisions, Talman Harris was exonerated in the complaint.

Read more: Racist FINRA Staff Jeffrey Bloom Reveals Regulatory Abuse

Like many hard working Americans, Talman Harris believes life could better if he could just work hard and take care of his clients and his young family – as part of America’s “melting pot”. Harris never realized how wrong he was when he joined FINRA. Talman Harris was doomed from the day when he became a stockbroker simply because he had an inherent problem out of his control: Talman Harris is a black man, under the thumbs of racist FINRA bureaucrats.

“Being black is being evil…”, says Jeffrey Bloom, a notorious and racist FINRA staffer

Sex, Lies and Duped FINRA Staff

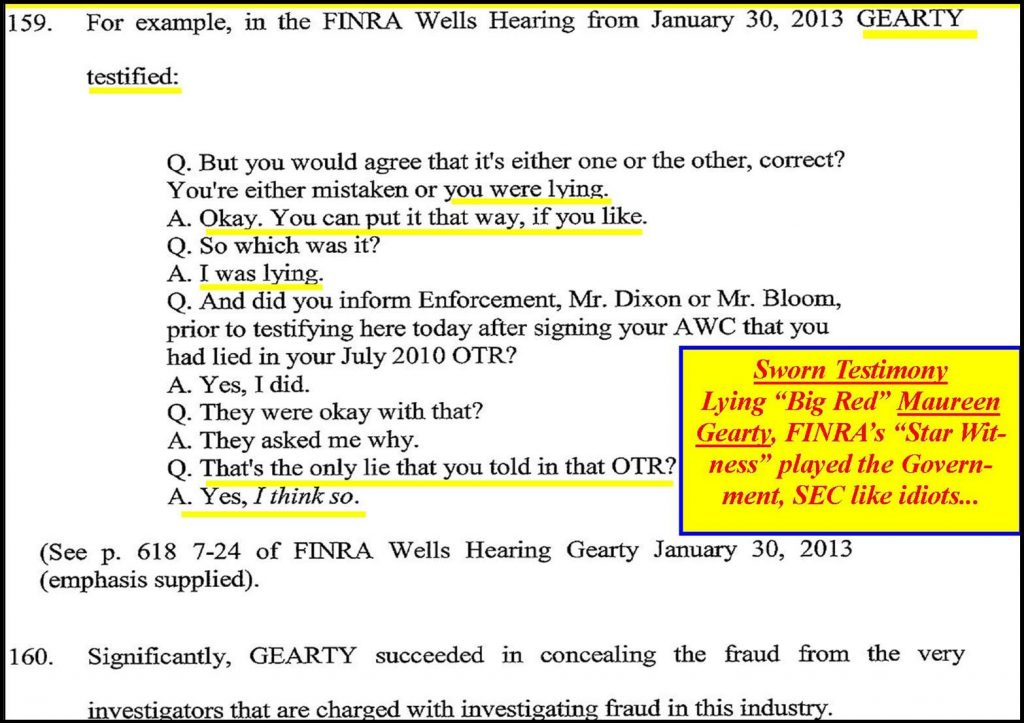

In an arbitrary decision made with a complete lack of due process or clear factual evidence, the National Adjudicatory Council (NAC), the supposed review arm of the Financial Industry National Regulatory Authority (FINRA) affirmed an enforcement decision against brokers Talman Harris and William Scholander, barring them from the financial industry based on the testimony of one single person – “Big Red” Maureen Gearty, who is the mistress and sex partner of the convicted felon Ronen Zakai, despite astounding facts that Gearty admitted to lying to FINRA investigators at least on four separate occasions.

Read More: CHRIS BRUMMER, GEORGETOWN LAW SCHOOL PROFESSOR IMPLICATED IN MULTIPLE FRAUD, ABUSER CAUGHT

The account of events by Maureen Gearty, a former associate of the firm where both men worked, was the sole authority used to establish the case, and the Hearing Panel, led by an impotent and sleepy FINRA bureaucrat Myles Edwards deemed Maureen Gearty credible, though she admitted to lying on four separate occasions and was directly involved in the promulgation of a Ponzi scheme with another broker, Ronen Zakai, who was later sentenced to four years in prison for stealing investor’s money.

That she was credible and evidence received was legitimate is at least a stretch, not to mention the other gray areas used as black and white to establish the guilt of Harris and Scholander.

Read More: RONEN ZAKAI, FINRA STAR WITNESS DUPED FINRA, CHRIS BRUMMER, GEORGETOWN PROFESSOR FOOLED

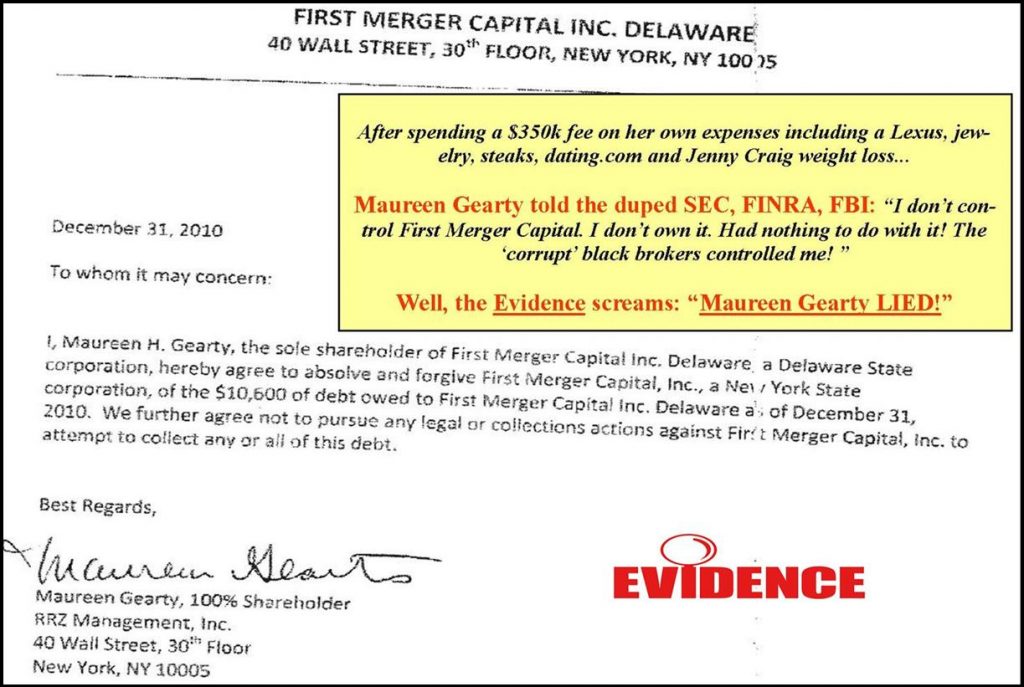

Maureen Gearty – the real boss behind First Merger Capital

Maureen Gearty and her “bedroom playmate” Ronen Zakai conspired in an attempt to acquire a broker-dealer business – with Zakai and Gearty owning about half of a company to named First Merger Capital. A broker-dealer is a business permitted to perform financial transactions, and buy or sell securities. FINRA claims Harris, Scholander and Zakai were planning to become partners in the broker-dealer.

In reaching the bar decision against Harris and Scholander, FINRA relied on the belief that Talman Harris and William Scholander were the “bosses” at First Merger, and Maureen Gearty and her lover Ronen Zakai were simply following “orders” from Harris and Scholander. Though all the funds FINRA claims would be used to acquire the business were in a bank account solely controlled by Zakai and Gearty, the case alleges that Harris and Scholander solicited an illegal consulting fee in furtherance of the plan.

Read more: ED KNIGHT, NASDAQ GENERAL COUNSEL CAUGHT IN RIGGING NASDAQ LISTING SCANDAL…

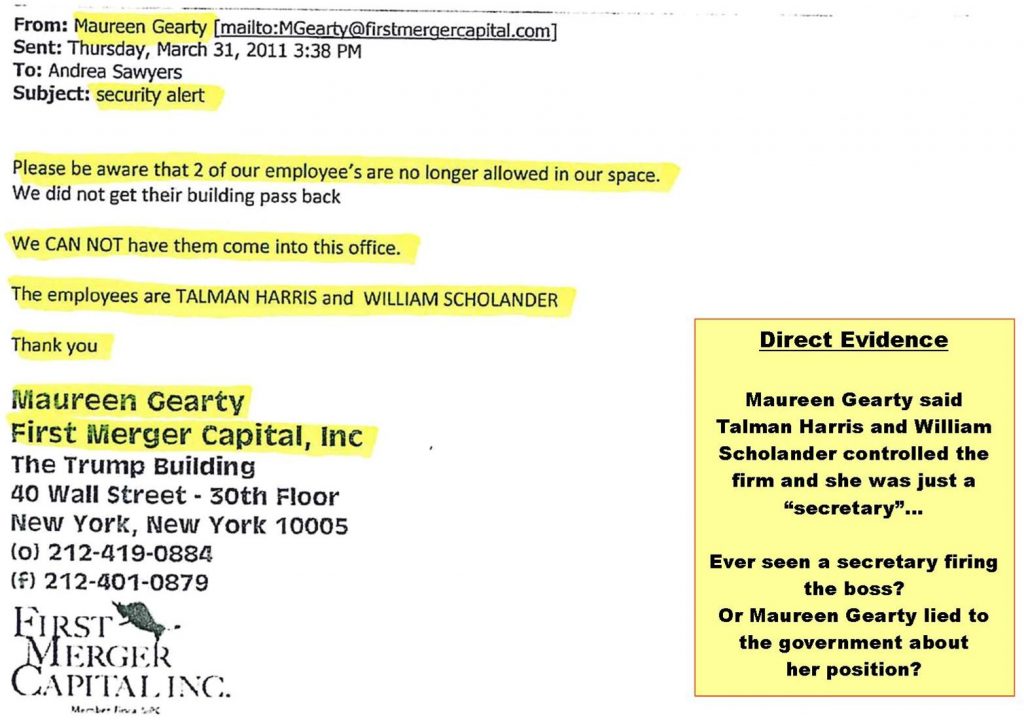

The facts however point to the opposite. Investigative materials turned up troubling evidence against FINRA’s allegations. An email produced by Maureen Gearty clearly shows she was in charge. In fact, the damning evidence against FINRA shows it was Maureen Gearty who had ordered the office building manager to shut Harris and Scholander out of access to their offices, because they were her “employees”. Meanwhile, Gearty had lied to FINRA that she was just a secretary working under her bosses Talman Harris and William Scholander…

Have readers ever seen a “secretary” firing the bosses, or, in reality, the real boss was in fact Maureen Gearty, who had the authority to fire Harris and Scholander while acting a conspiracy with her honey boyfriend Ronen Zakai to take control of the entire firm…

FINRA was wrong. FINRA staff knew they were wrong. And they still proceeded against Harris and Scholander despite these facts flying in the face… “Being black is being evil…” said FINRA’s Jeffrey Bloom.

At FINRA, black lives don’t matter. That’s the truth at FINRA.

BREAKING NEWS: CHRIS BRUMMER, FINRA RUBBER STAMP, GEORGETOWN LAW SCHOOL PROFESSOR IMPLICATED IN MULTIPLE FRAUD

Read more: FINRA: The ‘Impartial’ — and Corrupt — Wall Street Watchdog

FINRA, a kangaroo court run by kangaroos

The crux of the allegations against Harris and Scholander surround a trip to China that Scholander and Gearty made to Deer Consumer Products, a kitchen appliance manufacturer.

“They deemed her credible,” William Scholander told investigative reporters at TheBlot Magazine – Voice for the Voiceless. “FINRA’s kangaroo court is one-sided.”

Scholander and others believe that instead of targeting large firms, FINRA goes after smaller companies like where he and Harris were employed because many of the employees at those type of companies do not have the resources or wherewithal to fight them. He has spent significant amounts of money on his defense and is, in effect, out of work because he is not allowed to practice his profession and could be made to wait another six months before the Securities and Exchange Commission (SEC) takes on the appeal.

More:

Read more: INVESTIGATIONS: DISGRACED NASDAQ OFFICIAL MICHAEL EMEN REVEALS NASDAQ AS AN INSTITUTIONAL RACIST, ED KNIGHT IMPLICATED…

“They try to outspend you,” he said. ‘They will do whatever they want to get the result they want in an investigation. In a FINRA hearing, facts don’t matter. It’s totally arbitrary.” Scholander’s statements were echoed by several other seasoned brokers.

FINRA: INCREDIBLY NOT CREDIBLE

The investigation, enforcement action and affirmation by the NAC panel all occurred without a single customer complaint against Scholander and Harris. The decision to bar them was based on an earlier FINRA enforcement decision which was affirmed by the Hearing Panel. Gearty testified that she changed a previous story related to the case because she was intimidated by, and in fear of, her potential partners, but had been rumored to be having an affair with Zakai and willingly entered into business relationships with all three men.

In a brief disputing these claims, Talman Harris and Scholander claim Maureen Gearty is not a credible witness and point out cracks in her testimony. Neither Harris or Scholander ever had access to the account holding the $350,000, and instead of targeting the Social Innovation Fund — the fraud for which Zakai was put away — FINRA built a case against the two men, and took down honest brokers instead of a convicted criminal.

The enforcement action claims that under FINRA and SEC rules, a $350,000 payment from Deer should have been disclosed to Harris and Schoanders’ employer at the time, Seaboard Securities, and that failure to do so was a fraudulent omission, even though it was not their money or ever under their control.But this actually exists in a gray area, as the rule they supposedly violated states that members should conduct business and “shall observe high standards of commercial honor and just and equitable principles of trade.” The case alleges that the three men, along with Gearty conspired to use the fee to acquire a broker-dealer business, which in truth, Gearty and Zakai always controlled

The second regulation the men supposedly violated is quite a stretch as well. It states: “No member shall effect any transaction in, or induce the purchase or sale of, any security by means of any manipulative, deceptive or other fraudulent device or contrivance.” Legal discussions and arguments related to whether this occurred, or should even be a violation, are completely glossed over and ignored in the allegations against Harris and Scholander. Evidentiary exhibits tied to their appeal were also omitted from the record in the case against them, another example of the extralegal means FINRA uses in enforcement.

More:

My Wife, Ruined by Georgetown Law Center Professor Chris Brummer, Reveals the Disturbing Truth

Read more: Aegis Capital Fights Back Against FINRA Blackmail, Racism

Seeking justice at the Securities and Exchange Commission

Both men are appealing the enforcement decision to the SEC, the parent organization charged with FINRA oversight. To subject both men to lifetime bars, despite them having no prior sanctions or consumer complaints logged against them, seems to be an extreme punishment. Not only does it seem an extreme penalty for the offense committed, the process which the decision was arrived at is also unfair, biased and relies on an extralegal process that denies Harris and Scholander their constitutionally guaranteed due process protections.

FINRA’s star witness landed in jail, Chris Brummer, a Georgetown Professor, FINRA’s uncle Tom

Eventually Gearty and Zakai landed in hot water, and Zakai in prison for stealing investors’ money in a fraudulent pool of investments named the Social Innovation Fund. Both Harris and Scholander acted as whistleblower’s on the fraud, refused to invest in it and urged their clients not to as well. They were both fired by Gearty and Zakai, incredibly from a firm FINRA claims the supposedly own a part of.

Why such an extremely harsh and unfair penalty for Talman Harris and William Scholander? Both have worked in the industry for almost two decades, previously had no regulatory history and were shown the front door and told to effectively retire from the industry.

Scholander is from a modest background and had worked at many different jobs since age 12, including unloading trucks at supermarkets. While selling electronics for now-defunct chain store The Wiz in Brooklyn, he had a chance encounter with a stockbroker, who told him that since he was a good salesman, he could be successful in the financial industry. That was the impetus for Scholander to begin his career in the industry.

Read more: CATCHING STOCK FRAUD CRIMINAL JON CARNES, THE REAL-LIFE WOLF OF WALL STREET

As far as Mr. Talman Harris, he has a real problem in the world of FINRA: Talman Harris is a black American and we all know what the blacks were called the “N word” just a few decades ago. There is no evidence barring these two heroic Americans. Does it matter for FINRA? No. In the book of FINRA however, it is a white men’s elite club. Harris could not possible get ahead, he is black.

More:

Fraud, Lies, Georgetown Law ‘Professor’ Chris Brummer, Rigged FINRA NAC Sued for Fraud, Defamation

FINRA’S FLIMSY CONSPIRACY, RACISM

When failure to disclose outside business activities is in a legal gray area, and an entire case is based on one person’s testimony, a person associated with a convicted criminal, it’s hard to understand why the decisions were affirmed and Scholander and Harris were barred by FINRA.

Adding to the biased process is the way in which evidentiary exhibits were handled, and the person who brought the case, Jeffrey Bloom. Blooom not only was a member of the three-person Hearing Panel, he was also the main investigator on the original case against Harris and Scholander.

The severity of the penalty surprised Scholander, given what was alleged and previous punishments for similar violations, though the NAC and FINRA have done a poor job of tying the payment directly to the two men. Both he and Harris claim it was, at all times, in an account solely controlled by Gearty. She both controlled the funds and spent it all on office furniture and to lease space for Zakai.

Read more: PROFESSOR CHRIS BRUMMER, AN UNQUALIFIED CFTC NOMINEE IN A SECRET DARK CLOSET

That an at-best flimsy conspiracy formed the majority of the case against these two men further adds to the lengths one investigator went to punish them.

“We didn’t know we would be thrown out of the business,” Scholander said. “They’re above the law. They say it’s a bar, it’s a bar because they say so. People in the securities industry are regularly subject to abuses. We are not alone.”

Even if he and Harris get their jobs back at some point, to Scholander, the process has taken a pound of flesh in legal fees and lost business.

“The one thing we don’t get back is the money we have spent fighting this nonsense in lawyer’s fees and so much lost business,” he said.

More:

FINRA NAC, NATIONAL ADJUDICATORY COUNCIL KANGAROO COURT, RUBBER STAMP

Read more: Criminal Conviction: Facebook Fraudsters Ronen Zakai, Maureen Gearty Duped FINRA

In legal briefs prepared on behalf of both men, lawyers argue that Gearty is not a credible witness, and her testimony should not form the basis of the case against Scholander and Harris. Specifically in the judgment against them, it is mentioned that she lied about who approached her with the idea of taking a trip to China to meet with company representatives of Deer Products.

This forms the central and most severe basis for fraud charges against Scholander and Harris; the payment both men claims was for Gearty, but the Hearing Panel found to be meant for acquisition of a broker-dealer business that Harris and Scholander had put into place together with Ronen Zakai, who was arrested in 2103 on 11 felony charges connected to the Social Innovation Fund. He pleaded guilty and is currently in prison serving a four-year sentence.

The allegations charge that both Harris and Scholander did this with that knowledge that it was, in fact, a violation. FINRA’s case also claims that both men were aware that a fee would be received from Deer Products after the trip to China, and that money would be used to purchase a broker-dealer. After interviewing two witnesses, one of whom was another FINRA financial industry regulator and Gearty, the NAC affirmed its own decision to bar Scholander and Harris.

Adding to the shady way in which this was done, Scholander’s lawyer was removed at the last minute by FINRA as he had previously worked with Gearty (once a party to a case claims a conflict of interest exists, that counselor can be removed from the proceedings)and Harris and Scholander were forced to retain new counsel.

More:

Alan Lawhead, Robert Colby, FINRA NAC, the Corrupt FINRA Watchdog is Full of Fleas

Read More FINRA CEO RICK KETCHUM PLAYED LIKE A FOOL, SPONSORS RACISM, ABUSER JEFFREY BLOOM, GEORGETOWN “UNCLE TOM” CHRIS BRUMMER CAUGHT PANTS DOWN

Both respondents filed an appeal denying the allegations and raised several affirmative defenses. After more than eight months, Harris’ and Scholanders’ appeal to have the enforcement decision dismissed on the basis of five evidentiary exhibits being omitted from the file by FINRA was denied by the NAC Hearing Panel.