Alan Lawhead, the abusive FINRA rotten “head” who knows no “law”

ALAN LAWHEAD, the director of Appellate Group at FINRA (Financial Industry Regulatory Authority) is a balding, grumpy old man making a shit load of money for himself while raping FINRA members. Alan Lawhead is far better known as “Alan the rotten ‘head’ who knows no ‘law‘” than his legal prowess. On his lousy LinkedIn page, Alan Lawhead beats his own drum as someone with “federal court experience in complex commercial litigation.” But what’s lurking below the surface for Alan Lawhead‘s shameless self-promotion is the truth revealed: Alan Lawhead has a notorious history of losing appellate cases and lying to judges.

BREAKING NEWS:

https://www.theblot.com/confession-georgetown-law-chris-brummer-implicates-finra-richard-ketchum-lies-told-fbi

“In the real world, stripped of his fake, puffed-up bio, Alan Lawhead is nothing but an impotent old fart and a hired gun paid to intimidate the shit out of spineless FINRA members.”

Michael Garaski, Alan Lawhead’s lawyer says Lawhead’s brazen disregard of the law is the result of a scientific invention – Alan Lawhead’s love affair with Pfizer’s magic little blue pills. Pouring down three at a time, Alan Lawhead turns into a supercharged regulatory rapist, ready to pull down his fatty pants charging towards anything that breathes. Soon, Alan Lawhead laid his bloody eyes on a black man named Talman Harris.

FINRA lawyer EDMUND POLUBINSKI III (Yes, this bald eagle sure loves this strange last name associated with a Polish sausage brand) has declined repeated requests for comment

“I want to nail that black dude,” the FINRA sicko Alan Lawhead allegedly told ASHLEIGH HUNT, a New Zealand law clerk at the tiny CLARICK GUERON REISBAUM, where its lawyers enjoy an organic form of Prozac.

More In-depth:

Robert Colby, Alan Lawhead, FINRA Defend Rape Charges Claiming ‘Regulatory Immunity’

Read more: Robert Colby, FINRA General Counsel Rigs FINRA NAC Kangaroo Court

Daren Garcia, Vorys, Sater, Seymour Ohio country lawyer muzzles free press

Facing an avalanche of media criticism, FINRA’s imbecile general counsel Robert Colby scouted around the internet and landed on the waiting traps of some obscure Ohio country lawyers named DAREN GARCIA and Mary Henkel – Mexican boys with VORYS, SATER, SEYMOUR AND PEASE LLP. It was a war. FINRA was desperate to muzzle the free speech of well-funded third party contributing writers backed by the billionaire Koch brothers.

Read more: PROFESSOR CHRIS BRUMMER, CFTC NOMINEE, TASTY DR. BRATWURST, BUT NO AG

Sources say the country lawyer Daren Garcia is an amigo raised on the Tex-Mex chilly peppers in Columbus Ohio, and Mary Henkel has a strange taste for SEMEN, NATURE’S PROZAC.

“With an insatiable appetite gobbling up corn Fajitas wrapped around frog legs, the Mexicano lawyer DAREN GARCIA touts his special ‘BBQ skills’ as an ‘internet defamation removal attorney.’ Nice bullshit!”

Daren Garcia’s nonsense sounded cool for the flimsy regulatory rapists at FINRA, namely Robert Colby, Alan Lawhead, Michael Garawski, Jeffrey Bloom, Chris Brummer – Dr. Bratwurst, Myles Edwards, but in truth, it’s Daren Garcia and Mary Henkel’s marketing crap to get into FINRA’s bloated pants.

Related:

“Daren Garcia is perhaps better known as the amigo that supports gay rights than his paltry legal knowledge about the internet.”

For Daren Garcia, there is nothing wrong being outed as a gay man! One should be proud of gay rights, even for the “conservative” Ohio cowboys at Vorys, Sater, Seymour. The Ohio law firm Vorys, Sater, Seymour is so proud of its gay lawyers that it even picked an “East Gay” street address as its head office, pledging allegiance to the LGBTQ community. Read more: ROBERT COLBY, ALAN LAWHEAD, FINRA DEFEND RAPE CHARGES CLAIMING ‘REGULATORY IMMUNITY.’

DAREN GARCIA likely failed his “Constitutional Law” class. Like thieves, Daren Garcia and his lovely companion Daniel Morgenstern quickly filled their empty Ohio pouch with the dumb money from FINRA, arranged by Robert Colby, the notorious FINRA regulatory rapist. But the Ohio gay boys haven’t done shit to earn the FINRA money – not a bad gig for a pair of “Ohio comrades” fiddling over the FINRA morons. When Daren Garcia and his boyfriend Daniel Morgenstern cozy up an unwashed bed sheet in Pittsburgh, it’s time for the “love birds” to read a law book called the “First Amendment.”

Read more: FINRA MEMBERSHIP, DOG ON A LEASH, FINRA NAC EXPOSED

Barely surviving on her own due to a string of losses in courtroom performance, the nasty lawyer Nicole Gueron, aka the “mudshark” also quickly pocketed FINRA’s dumb money.

“NICOLE GUERON is a dead meat lawyer from an equally obscure 3-person ‘shemale’ shop in New York, hired by FINRA to chill America’s free speech.”

More In-depth:

Nicole Gueron, New York Loser Lawyer Muzzles Press Freedom, Sponsors Racism

Known as the “mudshark lawyer with serious jungle fever,” Nicole Gueron put on her polyester jacket and was humiliated in total defeat from lying to judges. Read more: NICOLE GUERON, NEW YORK LOSER LAWYER MUZZLES PRESS FREEDOM, SPONSORS RACISM.

Teetering on the verge of bankruptcy, Nicole Gueron also made off like a bandit from FINRA’s money. “Why is FINRA putting up this losing fight? Covering up a crime sounds just about right,” said investigative reporters. “We will be on their fat asses every day exposing these regulatory rapists.”

“Has anyone taken Chris Brummer, Robert Colby, Michael Morris, Alan Lawhead and Jeffrey Bloom’s depositions yet,” said the renowned anti-FINRA lawyer Bill Singer. “You’ve got to sanitize FINRA’s nasty bed sheets quickly through discovery. FINRA’s dirty laundry of abusing their members will be aired publicly.”

Read more: CHRIS BRUMMER, PHONY GEORGETOWN LAW PROFESSOR IS A CRAVATH SWAINE MOORE LAW FIRM DROPOUT

Read more: FINRA BARRED TWO INNOCENT BLACK BROKERS BASED ON BS, RACISM, TRASHES THE AMERICAN CONSTITUTION

Alan Lawhead, the FINRA abuser rapes an innocent black man Talman Harris

TALMAN HARRIS is an accomplished stockbroker in New York. An American citizen, Harris has had a dream since childhood – becoming a financial adviser as a member of FINRA, the racist Financial Industry Regulatory Authority in order to manage money for his family. FINRA is a government agency that gives out exclusive licenses to investment advisers in the United States. For almost two decades, Talman Harris followed the law. But it wasn’t enough in the racist FINRA world.

“For more than 17 years, Talman Harris maintained a spotless regulatory history without a single customer complaint,” according to his broker CRD record.

But Talman Harris had an inherent problem: he is a BLACK man working in the all-white, racist FINRA Jurassic Park.

“By 2015, Talman Harris was gang raped by FINRA – from the front, the back and the side way! His life was ruined from fabricated FINRA charges.”

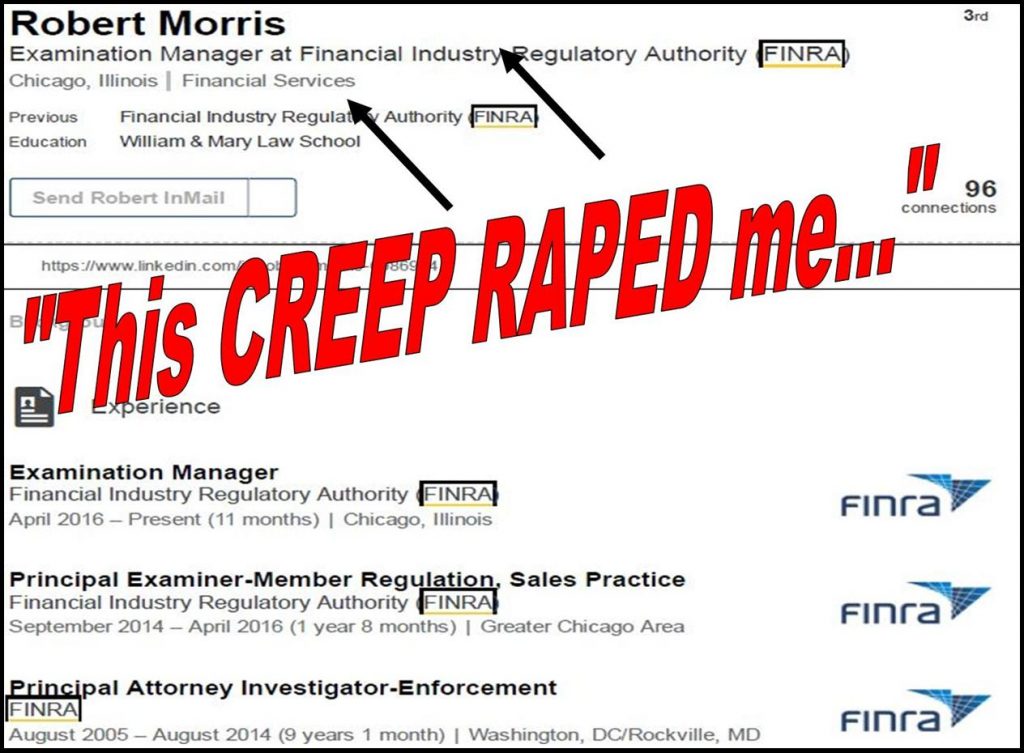

The FINRA rapists are on display in a rigged FINRA gallery: ALAN LAWHEAD, ROBERT COLBY, MYLES EDWARDS, JEFFREY BLOOM, ROBERT MORRIS, BILL PARK and the notorious Georgetown imbecile professor CHRIS BRUMMER, aka Dr. Bratwurst.

Read more: TABLOID WRITER RODDY BODY, SHAM SOUTHERN INVESTIGATIVE REPORTING FOUNDATION, A PLUNGER IN A CLOGGED TOILET

FINRA imbeciles lynched a black man Talman Harris

Here’s a story of Talman Harris’ path to the FINRA hell that has sparked so much outrage from the media:

“The horrific FINRA story is beyond conscience. It could get your guts wrenching, jumping up and down saying ‘holly shit, these FINRA fuckers are sick!'”

More In-depth:

Meet Chris Brummer, Georgetown Law Center ‘Dr Bratwurst,’ Fake Expert Ruins Lives

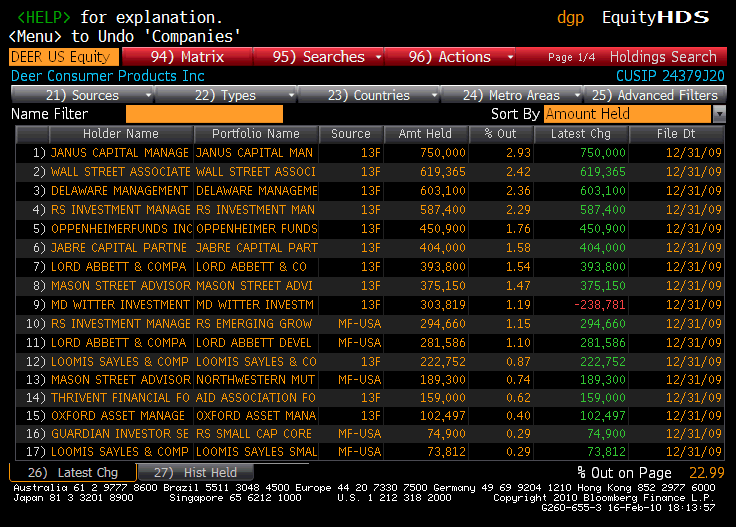

In 2013, FINRA and the moronic regulatory abusers Robert Colby, Jeffrey Bloom, Myles Edwards, Chris Brummer – Dr. Bratwurst wrongfully accused Talman Harris of “fraudulently marketing” Deer Consumer Products, a solid, highly profitable Nasdaq-listed (symbol: DEER) consumer products company. Deer is the world’s largest maker of juicers and blenders that has a 30-year operating history, famously produces products for more than 200 global brands such as “Magic Bullet,” “Mr. Coffee,” “DeLonghi,” “Hamilton Beach.” Deer has more than 10,000 employees and over $120 million in cash. It’s debt-free with hundreds of millions of dollars in net assets.

CHRIS BRUMMER, FINRA, Fabricating Deer Consumer Products market manipulation

Deer Consumer Products was twice added by the prestigious Forbes Magazine to its list of “Asia’s top 200 growth companies.” In 2009, Talman Harris’s employer was the investment banking firm formally engaged by Deer to raise capital through several equity offerings called “Private Placements.” Deer publicly disclosed the financing, which was approved on multiple occasions by the SEC under Deer’s S-1 registration statements. A dozen esteemed Wall Street investment banks independently covered the DEER stock with “Strong Buy” ratings in their research reports. These top investment banks set price targets on Deer at north of $18 per share, a lofty goal that was easily surpassed in the market due to strong institutional buying interest, giving Deer $1 billion in market value on the Nasdaq Global Select Market – the highly coveted Nasdaq tier where Intel, Apple and Microsoft also trade.

About 40% of the China-based Deer Consumer Products was owned by the world’s largestmutual funds: Janus Capital, Oppenheimer Funds, Guardian Insurance and others. Deer stock was also highly liquid, trading on average more than half a million shares a day, valued at more than $5 million a day. In 2011, Deer reported $226 million in revenues and $40 million in net profit – no debts. By 2010, Deer was a popular stock on Wall Street when the global financial crisis reached its peak. Investors gobbled up Deer due to its strong financial performance in comparison with depressed results reported by U.S. companies.

By 2012, Deer, the debt-free consumer product behemoth started paying a quarterly cash dividend – yielding more than 9% a year (in comparison, bank deposits paid less than 0.25% a year in interest), as disclosed in Deer’s SEC 10-K annual report filing, illustrated in the Bloomberg data below.

Read more: MELISSA HODGMAN, SEC ENFORCEMENT LAWYER HAD JOB PROMOTION RIDING ON ‘ASIAN SCALPS,’ LAWSUIT SAYS

Deer was a perfect job-creating growth story that could be easily understood by anyone with an ounce of brain. But it was too “complex” for the racist and DUMB FINRA regulatory morons.

Racial profiling against Talman Harris and Deer? It was obvious. Facts didn’t matter to FINRA.

“Market manipulation about DEER? There was none. Talman Harris was a black man and Deer was a Chinese company – those were the sins behind FINRA’s assassination of Harris’ character.”

The gang rape was in against Talman Harris by the FINRA regulatory rapists: Robert Colby, Jeffrey Bloom, Myles Edwards, Alan Lawhead, Chris Brummer, Bill Park and Robert Morris.

FINRA then duped the SEC, which in turn instigated a political hatchet job against William Uchimoto, a renowned Japanese American law and Deer’s legal counsel. Read more: Op-Ed: SEC Suit Against Lawyer William Uchimoto Is A Political Hatchet Job. (On March 27, 2017, a New York federal judge dismissed all claims against Uchimoto. Uchimoto sued the SEC for fabricating a case against him. Read more: CAN’T FIND CHINA ON A MAP, IMBECILE SEC LAWYERS LYNCH THE CHINESE.)

“Eager to advance their personal agendas, the ignorant SEC staffs MELISSA HODGMAN, CHERYL CRUMPTON, DEREK BENTSEN, STEVEN SUSSWEIN, JOSHUA BRAUNSTEIN, PATRICK FEENEY jumped on the ‘gang rape’ wagon against Talman Harris.”

READ MORE: GEORGETOWN PROFESSOR CHRIS BRUMMER SUED FOR FRAUD, BROKER TALMAN HARRIS FIGHTS FINRA NAC ‘MEAT GRINDER’

Broad institutional share ownership in Deer Consumer Products (source: Bloomberg):

Deer’s solid fundamentals didn’t fit into FINRA’s fabricated “pump and dump” story. FINRA started making the shit up and lying to the SEC and SDNY prosecutors and poorly educated rogue FBI agents.

An ignorant former Southern District of New York prosecutor named DAVID MASSEY took the FINRA bait like a brain-dead cat fish.

“FINRA said Deer was manipulated by Talman Harris. We took their words. Don’t blame me for their idiocy,” said David Massey, a disgraced former SDNY rookie prosecutor.

The facts however spoke volume. Talman Harris’ employer had “de minimis” participation in trading Deer shares on the Nasdaq – less than 0.002% of the entire trading volume, according to FINRA’s own records. Moreover, data showed the firm had sold more than it had bought for its customers during the same period – the opposite of the FINRA morons’ “pump and dump” fiction – the “dump” was actually before the “pump.” There was never “pump” or “dump.”

“Dumb FINRA idiots! These FINRA motherfuckers have ruined the black man Talman Harris’ life,” said MARY HENKEL, a self-proclaimed “internet defamation removal attorney.”

Read more: DAVID MASSEY, SHADY RICHARDS KIBBE ORBE LAWYER LOVES MONEY, TRASHES CLIENTS BEST INTEREST.

Read more: SEX, LIES, DUMB FINRA REGULATOR JEFFREY BLOOM, ROBERT COLBY MISSED NEW BERNIE MADOFF FRAUD

FINRA pumped another fake “market manipulation” case in SmartHeat

With rotten Eggs flowing on their fat faces, the regulatory rapists at FINRA made up another “market manipulation” case in SmartHeat.

FINRA’s fantastical “pump and dump” bullshit simply couldn’t be buttressed by the actual trading data from Bloomberg. But FINRA was determined to lynch the black man Talman Harris by the tree.

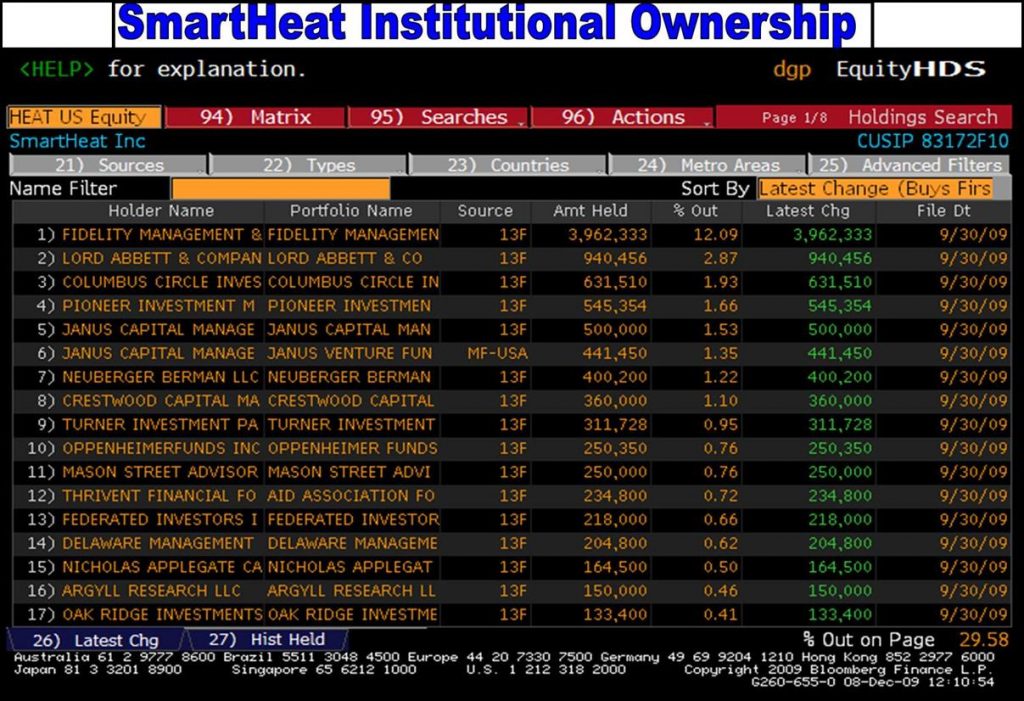

The FINRA racists trumped up a new “pump and dump” story involving a Nasdaq company named SmartHeat, Inc, which turned out to be a hugely embarrassing case of “eggs on the fat FINRA faces.” SmartHeat was 50% owned by top mutual funds in the world. The highly profitable clean-air solution company declared $125 million in sales and $27 million in operating income, according to its 2010 annual report in its SEC filing. SmartHeat stock traded traded like water: about 1 million shares a day and more than 400 million shares changed hands over the alleged two year period, valued at $5 billion. What about the trading volume by Talman Harris’ firm? Less than 0.0001%, a drop in the bucket.

Read more: African American broker Talman Harris Lynched by FINRA, because he is black

According to FINRA’s moronic “fantasy sport,” which was orchestrated by ALAN LAWHEAD, MICHAEL GARAWSKI, ROBERT COLBY, Dr. Bratwurst CHRIS BRUMMER, sleepy MYLES EDWARDS, Talman Harris was the chocolate God! FINRA accused Talman Harris of influencing the most powerful institutional investors in the world: Fidelity, Janus Capital, Oppenheimer Funds… Common sense? None. Who were stupid? FINRA’s ignorant regulatory idiots or the well-heeled Fidelity money managers that bought up 15% of SmartHeat’s entire outstanding shares directly from the open markets on the Nasdaq?

“Neither Deer nor SmartHeat has ever been accused of accounting or other improprieties. Talman Harris bought perfectly legitimate businesses. There was no corruption, no dump or pump. Certainly there were no kickbacks.”

Maureen Gearty, A $350,00 ‘kickback,” a fake story

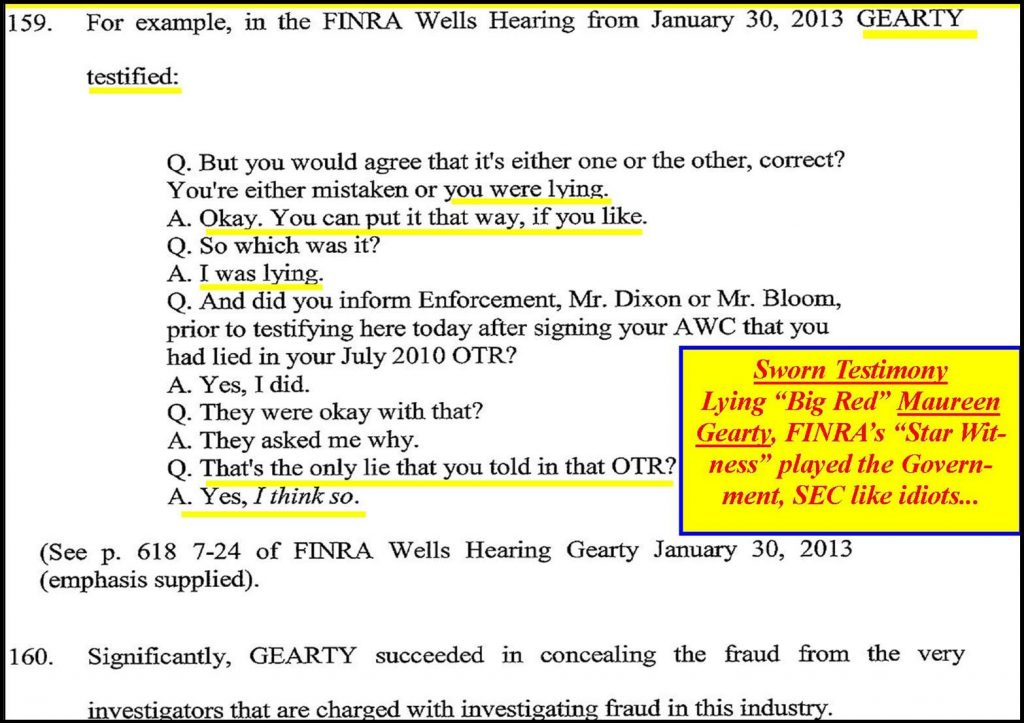

FINRA said it relied on fake stories told by Maureen Gearty, a 270 lb massive woman who allegedly had sex with FINRA NAC member Chris Brummer, aka “Dr. Bratwurst.” Gearty lied to FINRA and told the regulatory morons that somehow Harris had spent $350,000 from a company in the form of a “kickback.” Despite her own admission of lying to FINRA on multiple occasions, FINRA could care less about the truth:

Harris sued Gearty for defamation and the evidence came to light in the New York federal court: It was Gearty who had spent the money earned from Deer, approved by her own lawyer. Maureen Gearty spent every penny of it chewing on fat meat at steakhouses, dating.com and Jenny Craig weight loss programs. It was a plot developed by Gearty and his married Israeli lover Ronen Zakai to incriminate Harris to cover up their Ponzi scheme. Read more: CRIMINAL CONVICTION: FACEBOOK FRAUDSTERS RONEN ZAKAI, MAUREEN GEARTY DUPED FINRA.

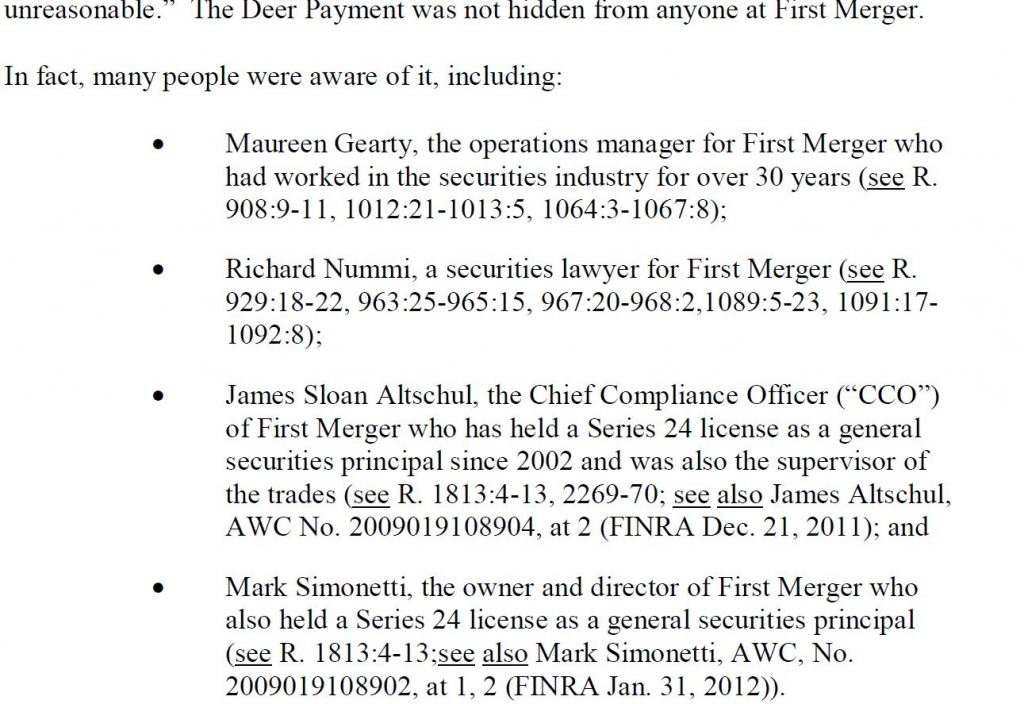

In Harris’ 2nd circuit appeal brief, a section of fact was provided here, which also shows Maureen Gearty and her firm’s knowledge of the $350k payment:

Maureen Gearty’s own bank account shows Gearty lived a lavish lifestyle, bought herself a Lexus, signed up with match.com, had regular dinners at fancy steakhouses and even a membership at the weight loss program Jenny Craig – all with investors money.

Talman Harris went to Congress to complain about FINRA’s racial discrimination against him. Harris also sued FINRA and the SEC for their misguided, fabricated claims against him, revealed in the Second Circuit Court of Appeals lawsuit:

“Despite this finding, the SEC then speculated about the payment in a manner unsupported by the record. The SEC’s guesses, however, do not constitute its or the NAC’s findings – which was that the payment was “not transaction based” – and thus cannot constitute the basis of its decision.”

“FINRA was wrong, dumb, moronic, vindictive, malicious and racist! The trading data tells the truth,” said William Uchimoto, a leading securities lawyer

To nail Talman Harris to the ground, FINRA made up a fake “market manipulation” case against Harris. Although the fiction lacked merits, FINRA dragged Talman Harris in 2013 through FINRA arbitration.

“The fabricated FINRA enforcement case was led by FINRA’s top brass from the very beginning, in collusion with FINRA’s entire ‘independent’ hearing processes – a FINRA arbitration panel and the FINRA NAC kangaroo courts.”

FINRA abuse, a racially charged fiction against a black man

It all started with the racist FINRA enforcement staffer Jeffrey Bloom ( Tel: 202-7218395; Email: jeffrey.bloom@finra.org), a bald loser desperate to advance a lagging career. Jeffrey Bloom made up the case against Talman Harris and submitted it to a moronic, sleepy FINRA internal arbitrator by the name of MYLES EDWARDS, now a lawyer at Jewish penny stock promoter Shufro, Rose & Co in New York. As expected, Myles Edwards got paid and rubber stamped the FINRA enforcement decision. By 2014, the case escalated within FINRA to its National Adjudicatory Council, or FINRA NAC, another FINRA kangaroo court.

Read more: Myles Edwards, Dumb FINRA Arbitrator Implicated in Ronen Zakai Felony Conviction

In March 2014, a FINRA NAC hearing panel was gathered by Chris Brummer, a creepy Georgetown Law nutty professor notoriously known as Dr. Bratwurst, because of his ludicrous degree in “Germanic Studies” – grilling Bratwurst and banging loose European women.

“It’s still a mystery today how the Dr. Brutwurst – Chris Brummer, someone who had zero experience in financial regulations could become a FINRA NAC member arbitrating complex financial cases.”

FINRA and SEC, the plunger and the clogged toilet in a sexual affair

Sources say Brummer’s wife Rachel Loko Brummer, an SEC staffer had pitched the Dr. Bratwurst moonlighting FINRA NAC job directly to FINRA’s Robert Colby, despite Dr. Bratwurst Chris Brummer’s appalling lack of qualifications. Read more: CHRIS BRUMMER, THE CURIOUS GEORGETOWN LAW PROFESSOR KNOWS NO LAW. As expected, Chris Brummer ruled against Talman Harris, based on testimony from a FINRA key witness “Big Red” Maureen Geaty, who had admitted to “repeatedly lying to FINRA.” Chris Brummer allegedly had sex with the 250 lb Maureen Gearty, a regular customer of weight loss program “Jenny Craig.” Sources say the alleged sexual affair between Chris Brummer and Maureen Gearty led to FINRA NAC’s ruling against Harris.

To no avail within FINRA, Talman Harris appealed the FINRA NAC decision to the SEC. That was when the FINRA bullshit got even more interesting. The SEC rubber stamped the FINRA NAC decision and ruined Talman Harris’ life. It all sounded good and proper, except,

“the SEC staffer who affirmed the FINRA NAC decision is Rachel Loko Brummer, Chris Brummer’s young wife who Brummer had bedded when Rachel Loko was his student!! “

Rigged? FINRA Hearing process is a kangaroo court

The courageous Talman Harris appealed the FINRA-SEC abuses to the Second Circuit Court of Appeals. The fabricated case fell into the lap of Alan Lawhead to defend the FINRA trash. MICHAEL GARAWSKI, another FINRA rapist also joined the lynching of a black man.

According to Talman Harris’ appeal brief with the Second Circuit Court of Appeals, the DEER financing received blessings from layers of Harris’s supervisors that included his direct manager Maureen Gearty, the firm’s lawyers, compliance officers and was signed off by the firm’s president. As a series 7 licensed broker, Talman Harris followed their guidance and introduced the stock to his clients.

The professional relationship between Harris’ firm and Deer was known to everyone, nothing was hidden, explained in Harris’s appeal brief to the 2nd Circuit Court of Appeals below:

More:

Robert Colby, FINRA Chief Legal Officer Fell on Regulatory Rape Charge

The end result is the same: FINRA fabricated a case against Talman Harris and raped his 18-year pristine reputation. The Appeals Court is expected to rule against the FINRA, SEC abusers by mid 2017.

Read more: FINRA MEMBERSHIP, DOG ON A LEASH, FINRA NAC EXPOSED

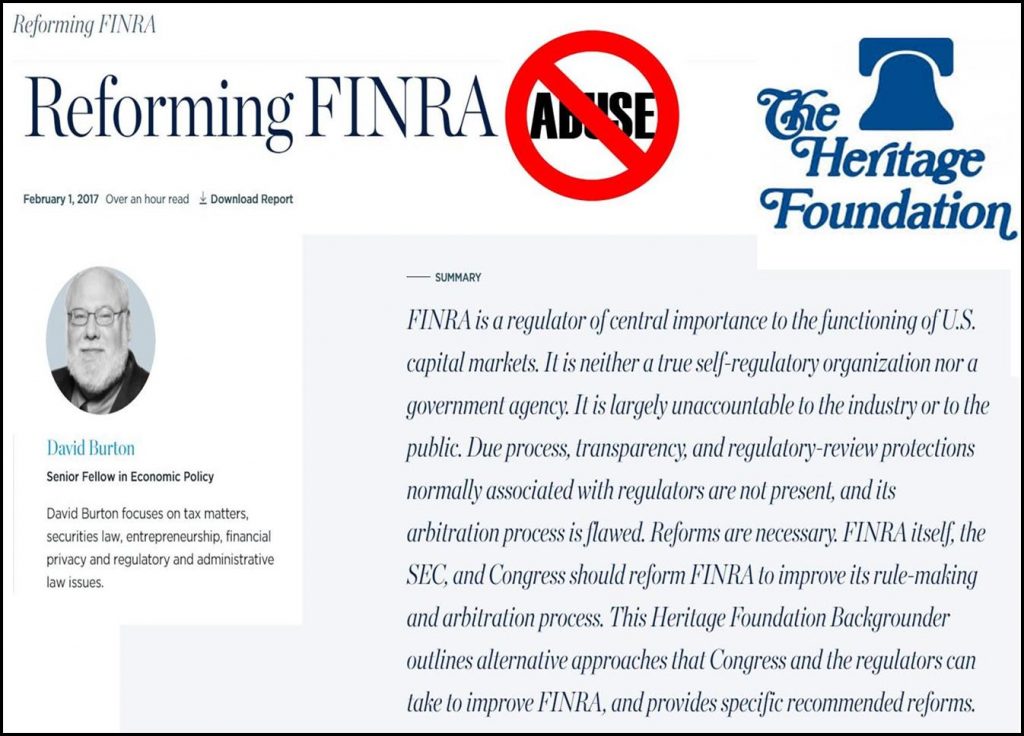

FINRA, a $2 billion a year “nonprofit” rape machine blasted by The Heritage Foundation

FINRA is a private club for regulatory abusers. FINRA is a $2 billion a year “nonprofit” business and touts itself as America’s watchdog. Sitting at the helm of this bitch with fleas is Robert Colby, a multimillionaire bureaucrat and the Chief Legal Officer of FINRA. An impotent “regulator” who forgot to regulate his own behavior, Robert Colby collects $200,000 a month from FINRA, paid for by fines from FINRA members.

“At his sole discretion, FINRA general counsel Robert Colby could lynch a black man by a tree or send a Jewish broker to a gas chamber.”

More In-depth:

Robert Colby, FINRA General Counsel Rigs FINRA NAC Kangaroo Court

The highly respected The Heritage Foundation released a scathing report titled “Reforming FINRA” on February 1, 2017 blasting FINRA and FINRA’s unfair regulatory process, calling out FINRA as “largely unaccountable to the industry or to the public. Due process, transparency and regulatory-review protections and its arbitration process is deeply flawed.” The entire report is here.

Read more: LYING, CHEATING, STEALING: EXPLOSIVE HERITAGE FOUNDATION REPORT EXPOSES FINRA, FINRA NAC REGULATORY ABUSES

The Heritage Foundation is right: FINRA is rife with abuses and fraud.

“Inside the FINRA dog house, there is no law, there are no rules. Federal Rules of Evidence, the critical component of fair administration of justice do NOT apply to FINRA members or FINRA arbitration.”

As a member of FINRA, you are a slave to the abusive masters headed by FINRA cronies ROBERT COLBY, ALAN LAWHEAD, MICHAEL GARAWSKI, CHRIS BRUMMER, JEFFREY BLOOM and their surrogates. Within the massive FINRA bureaucracy, Alan Lawhead is a loser and a nobody. His entire existence rests on washing the dirty laundry for Robert Colby, FINRA’s notorious, racist know as “crooked Robert Colby.”

Tabloid writer Roddy Boyd, a long-time critic of FINRA and FINRA NAC abuses could hardly hold back his criticism towards FINRA: “FINRA has a history of doing very lousy work for investors. My daughter Samantha Boyd could have done better.”

Black American broker Talman Harris has his own horror stories to share about FINRA abuses. “My reputation was raped, shredded into pieces by FINRA, FINRA NAC, Alan Lawhead and his impotent boss Robert Colby,” said Talman Harris. “FINRA’s Dr. Bratwurst Chris Brummer made fabricated a case against me only because I am a Black man.”

“Alan Lawhead is a nasty, dirty FINRA tool, like a plunger to unclog an abusive, stinky FINRA toilet.”

The FINRA Nazi bitch, barking at a non-FINRA member

FINRA is regulatory abuser and a FINRA membership is a dog on a leash. FINRA staff can bark at you and smear you even if you are NOT a FINRA member, even when you have nothing to do with FINRA.

“Literally, you could be the guy walking in the street and getting hit by ‘FINRA enforcement’ for some fabricated ‘securities law violations,’” said an investigative journalist. “FINRA can fuck with you no matter who you are. That’s called abusive power.”

On paper, FINRA is an noisy, annoying marketing promoter. FINRA NAC calls itself America’s “self-regulated” entity. In truth, FINRA is a monopoly created during the financial crisis when Wall Street fat cats ruined America. FINRA membership is deeply flawed: unless you pay hefty fees to join FINRA, you can’t even do business as an investment broker. Once you join FINRA, you have just bought yourself a ticket to hell. FINRA membership is a nail in the coffin.

The obvious setup in a FINRA NAC kangaroo court is to ensure FINRA NAC does not toe a different party line from FINRA’s. It works great for FINRA and Robert L.D. Colby: No wonder FINRA supports FINRA NAC. Why wouldn’t kangaroos support their own kangaroo courts?

“FINRA NAC rules in favor of FINRA staff against its members 100% of the time! Vladimir Putin’s Russia can’t do better!“

Read more: ROBERT COLBY, FINRA CHIEF LEGAL OFFICER FELL ON REGULATORY RAPE CHARGE

Congratulations to FINRA, FINRA NAC and Robert Colby for rigging America’s securities industry! They have just fucked up another black man’s life.

FINRA NAC, a kangaroo court, the muddy morass of regulatory abuses

FINRA NAC has a stench of cow manure arising out of a long list of FINRA’s self-dealings and conflict of interest:

- Rigged FINRA NAC rulings: Historically, FINRA NAC sides with FINRA enforcement staff 100% of the time. Rigged?! (Even the “Big Brother” SEC only wins 50% of its contested cases in federal courts!)

- FINRA NAC members work in part time, moonlighting jobs paid by FINRA.(Would you bite the hand that feeds you?)

- FINRA NAC decisions are draftedand written by FINRA staff, approved by FINRA general counsel Robert L.D. Colby! (Wonder how FINRA wins 100% of its cases before FINRA NAC? )

- FINRA NAC members are handpicked by FINRA’s general counsel Robert Colby. Many have no industry experience. (Would a slave kneel before a master?)

- FINRA NAC members (“the jury”) are handpickedby FINRA general counsel Robert L.d. Colby for a specific case, who also picks FINRA enforcement staff (“the prosecutor”) to litigate the same case. Both report directly to Robert Colby. (The judge and the jury are picked by the same person? Say rigged?)

- FINRA NAC members are mostly unqualified folks with zero experience in the financial industry (For example, FINRA NAC member Georgetown nutty professor Chris Brummer, known as “Dr. Bratwurst” has a degree in “Germanic Studies!”- grilling Bratwurst sausages and drinking beer.)

- FINRA NAC is a cover for FINRA racism, fraud and outright regulatory abuses.

THE LATEST UPDATES: The highly regarded New York federal judge Alison Nathan ordered a rare “Franks Hearing” on January 23, 2017 in open court to investigate to the extent the notorious rookie FBI agents Matt Komar, Thomas McGuire and the moronic former prosecutor DAVID MASSEY have fabricated evidence, made up the law, lied to federal judges in gross violations of a citizen’s constitutional rights: Review the case summary and record! There was massive media coverage. It’s time to #DrainTheSwamp!

On March 27, 2017, New York federal judge Kevin Castel dismissed a fabricated SEC charge against William Uchimoto, Talman Harris’ lawyer.